Despite gains of global stock markets, the gold prices got support from the fears related to the strength of the second Coronavirus wave in the United States of America, and therefore the price of the yellow metal rose to $1787 an ounce, near its highest level in eight years, and settled around $1783 an ounce. Amid absence of important and influencing economic publications, the gold price will continuously interact with investor sentiment and the US update of new epidemic figures.

The US dollar index DXY fell to 96.57, which supported bulls' control of gold performance. Silver futures rose to $18,582 an ounce, while copper futures also closed higher at $2.7745 a pound.

On the economic side, a report from the Institute of Supply Management showed a major shift in US service sector activity in June. ISM said its non-manufacturing index rose to a reading of 57.1 in June from 45.4 in May, and any reading above the 50 level indicates an increase in service sector activity. Economists had expected the index to rise to a reading of 50.1. The sharp increase in the non-manufacturing index reflected the largest one month percentage increase since they first appeared in 1997.

The Shanghai Composite Index in China increased by 5.7%, recording the largest progress since 2015 amid a positive comment on the market from government media, as the Securities Times newspaper said that the promotion of a "healthy" emerging market after the epidemic is now more important to the economy than ever before . The official China Securities Journal said in an editorial that the Chinese economy is recovering while financial markets are attracting more capitals, paving the way for a healthy emerging market.

On the Coronavirus front, one of the most important engines of the market, new cases continue to rise, with the United States of America returning to the top of the global scene. Meanwhile, US President Trump is underestimating the seriousness of these new numbers. Trump's signature on the extension of a federal program that offers tolerant loans to small firms affected by the Coronavirus has alleviated some concerns about the latest numbers.

COVID-19 confirmed cases rose to 2.91 million in the United States, after record daily increases were seen over the weekend, and the death toll rose to 130,090, according to data compiled by Johns Hopkins University. This means that the death rate is around 4.5%. Over the past 14 days, 38 U.S. states have seen an increase in COVID-19 cases, led by Idaho, Montana, and Florida, while 11 states and Washington, DC have seen mostly similar cases, while one state - New Hampshire - has seen a decrease in cases, according to the New York Times tracker.

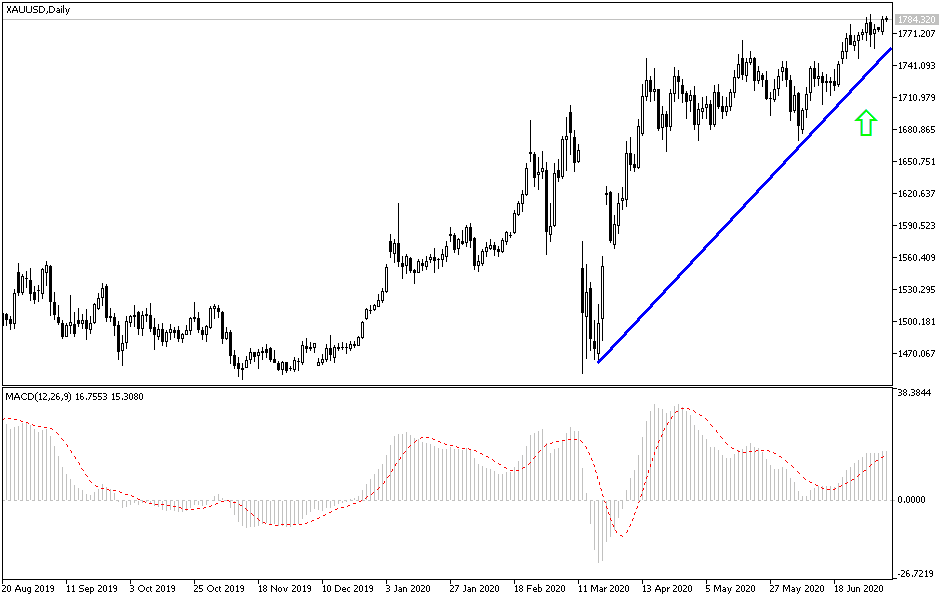

According to gold price technical analysis: The general trend of the yellow metal is still bullish, and despite the technical indicators reaching overbought areas, stability above the $1785 resistance will support the move towards psychological resistance at $1800 and above, which may happen later this week if the markets react negatively With new figures for the second coronavirus wave. There are recent reports that new types of viruses have emerged from China that may have a direct impact on the market.

The closest support levels for gold today are 1777, 1763 and 1750, respectively.

I still prefer to buy gold from every bearish level.