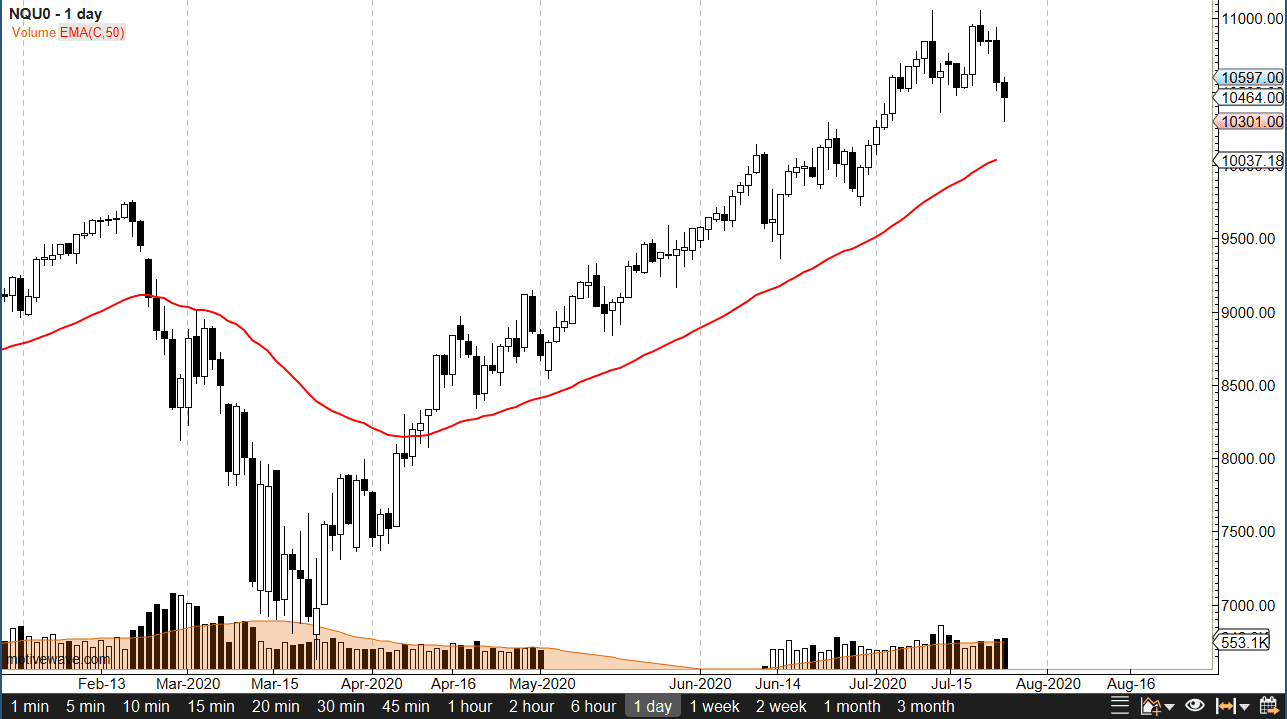

The NASDAQ 100 has pulled back from the 11,000 level during the most recent sessions, but as we roll into August, I think that the market is going to be looking for its footing for a more sustained move to the upside. After all, the 50 day moving average is just above the 10,000 level, that of course is something that people will be paying attention to as the 10,000 level is a large, round, psychologically significant figure. This is a market that I think will continue to see buyers on dips, as the markets continue to pay attention to the Federal Reserve more than anything else. The Federal Reserve is throwing money into the financial system, as the liquidity being forced down the throat of traders will continue to cause people looking for value.

That being said, one of the most important things that the market is moving on is the Federal Reserve but in the markets, and of course the weighting of the index. The index is heavily driven by Netflix, Alphabet, Microsoft, Apple, and Facebook. Those companies make up a significant portion of the index, roughly 33%. As long as those stocks continue to be darlings of Wall Street, this market will eventually find its way higher. I think the beginning of the month may see a lot of choppy behavior, with a floor down at the 10,000 area. Even if we break down below there, I think we will find plenty of support near the 9500 level and the 9000 level. It is a simple matter of where you buy the NASDAQ 100, not necessarily selling it off. This of course assumes that there is no massive shift in the geopolitical issues and attitudes around the world, which at this point are relatively contained, regardless of any attempt at panic. I think that the month of August is going to be very choppy, but there are still all the same drivers of the NASDAQ 100 higher than there always have been. It does not necessarily mean that we are going to simply explode to the upside though, because I do think that the 11,000 level is going to be a difficult barrier. Eventually we break above there then go looking towards the 12,500 level, perhaps in the middle of the month of August. I have no interest in shorting this market as things stand at the time of writing.