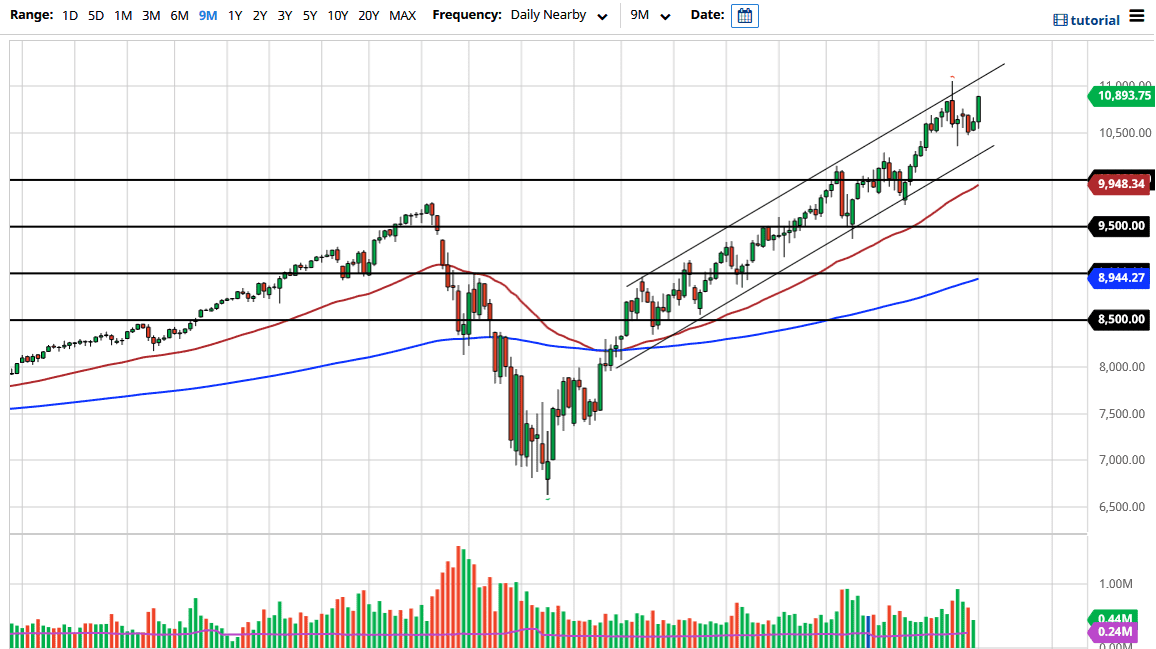

The NASDAQ 100 has rallied rather significantly during the trading session on Monday again, as Wall Street plows into just a handful of stocks as per usual. This is not a very healthy look at the market, but overall if you are trading the index it is what it is. We are reaching towards the 11,000 handle, an area that I thought could be rather crucial as it is not only a large, round, psychologically significant figure, but it is also the top of the channel. That continues to see a lot of attention, and I think that a pullback from that area would make quite a bit of sense.

Even if we do pull back from here, I believe that we have now established that the 10,500 level is going to offer quite a bit of support, as it was supportive in the past. The fact that we have exploded to the upside and then closed at the top of the range for the day does suggest there are plenty of people willing to get involved. Yes, I recognize that the stock market is not reflecting reality out there, but it has not been doing that for quite some time.

I believe that you should look at this as a “buy on the dips” type of market, because not only is earnings season going to cause the occasional resistance or sell-off, it is going to create value as traders come back on board. The trading session really started to take off to the upside once New York got on board, although the Globex move was relatively strong as well. I have no argument to sell this market, other than the fact that we might be a little bit overbought but at the end of the day if you have tried to short this market with the exception of a few times here and there over the last several years, you probably have lost a ton of money. Retail traders make the mistake of trying to pick the top of the market quite a bit, and retail traders typically lose a lot of money. That in and of itself should tell you not to fight what is going on. You have two options here: You can be correct, or you can be profitable.