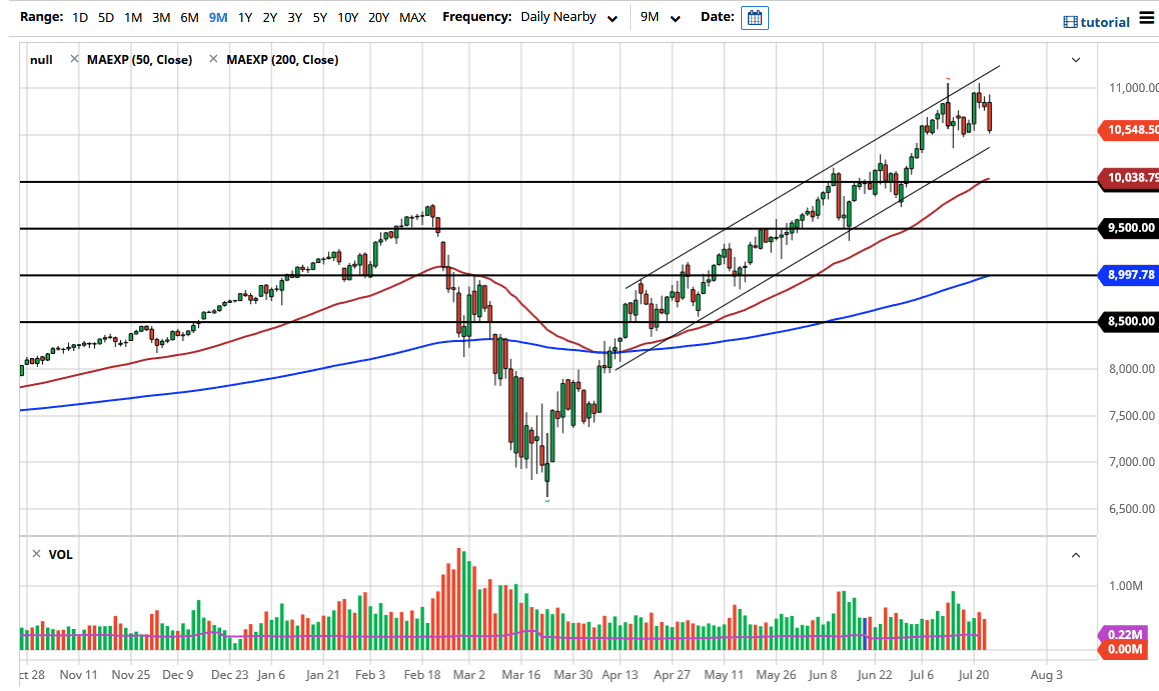

The NASDAQ 100 has broken down significantly during the trading session on Thursday, reaching down towards the 10,500 level. This is an area that has been massive support in the past, so it does make sense that we will more than likely find plenty of buyers eventually. The uptrend line at the bottom of the channel will be an area of interest, just as the previously mentioned level is. I think at this point it is only a matter of time before the buyers return and therefore it is likely that we will see the uptrend continue. Apple was a main problem when it comes to this market, and now it looks like the fact that there are only a handful of stocks pushing things around is causing quite a bit of noise.

Looking at this chart, you can see that we have been in a channel for some time and I do not expect it to break, but even if it did, I think there are plenty of reasons to think that there are buyers underneath. The 50 day EMA currently sits near the 10,000 level, an area that is a large, round, psychologically significant figure. With that in mind, I think that the trading public will more than likely continue to look at dips as a potential buying opportunity.

I think that the size of the candlestick is something worth paying attention to, as it is relatively big. Ultimately, I think that we will probably see some type of buying opportunity, but we may bounce around in this general vicinity heading into the weekend. After all, this is a market that only goes up over time, although we do get the occasional nasty selloff. I like the idea of buying dips as they occur, but we may have a little bit further to go in the short term. I do believe that the 10,000 level is essentially a “line in the sand” that is going to cause some issues and should be paid close attention to. I do fully expect some type of bounce there, so if we were to break down below that level then things get a little bit dicey at that point in time. In general, I think we are looking at longer-term bullish pressure.