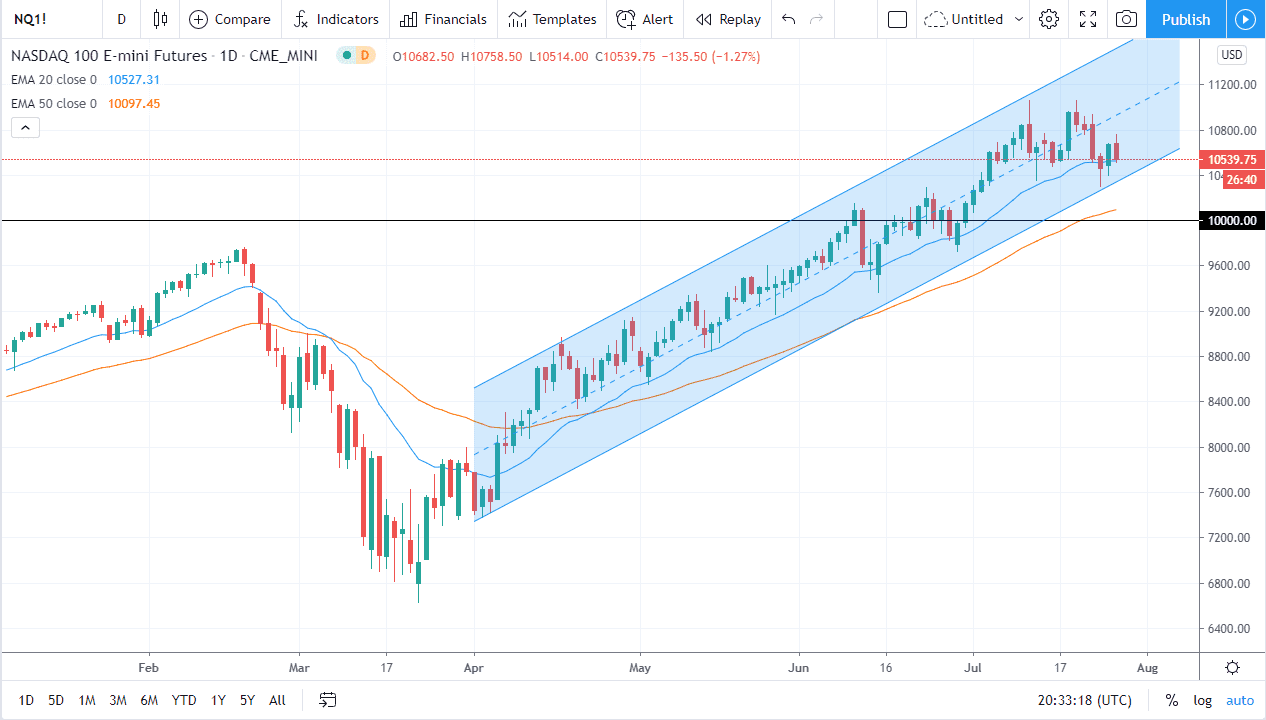

The NASDAQ 100 has initially tried to rally during the trading session on Tuesday but seems as if it is stuck in a channel, at least in the short term. Ultimately though, the NASDAQ 100 has a lot of noise out there to deal with, as we are in the midst of earnings season. Beyond that, we also have multiple support levels underneath. The first one of course is the 20 day EMA that I have marked on the chart, sitting just below the close for the trading session. It should be noted that most of the selling was done later in the day, so the question becomes whether or not that is institutional selling, or simply people getting out of the way for earnings? After all, AMD was reporting after the close, which is very positive so we could see this market turn around.

There was a bit of a pause when it comes to the consumer confidence, but really at this point it also will come down to stimulus as well. Washington will more than likely send out more stimulus, as the economy has been looking for some type of help and of course Wall Street most certainly has been looking for it as well.

Underneath the current trading action, there should be plenty of support near the 10,500 level, and most certainly at the 10,000 handle. Furthermore, the 50 day EMA sits just above the 10,000 level so that is most certainly worth paying attention to as well. I think that any short-term pullback will probably be looked at as a buying opportunity because “stocks only go up” according to Dave Portnoy, which has suddenly become one of the soothsayers of the trading community. I think at this point he is right, mainly because the Federal Reserve will do whatever he can to support the market, and Wall Street can count on stimulus coming out of Washington DC. The market has been rallying based upon cheap money for well over a decade, so I do not see that changing anytime soon. Ultimately, I think we will go back towards the highs near the 11,000 level but we may need to see a short-term pullback in order to build up the necessary momentum to make that happen. A break above the 11,000 level more than likely send this market looking towards 11,500 level.