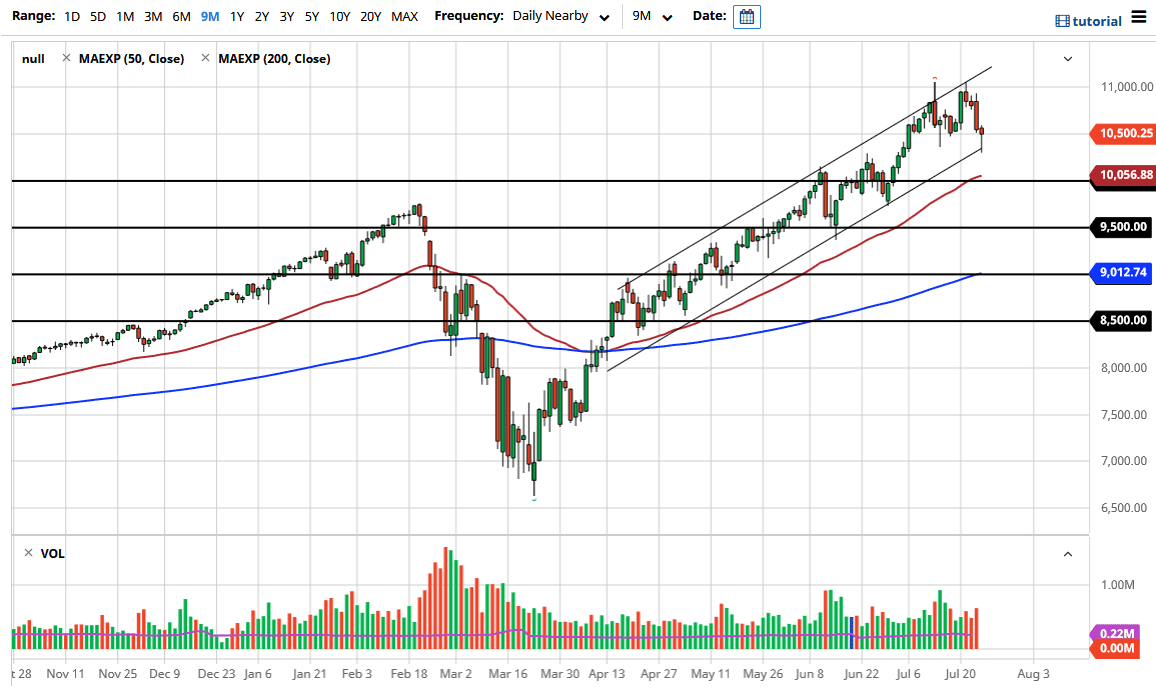

The NASDAQ 100 has pulled back significantly during the trading session on Friday, only to find support again at the bottom of the channel and form a massive hammer. Breaking above the top of the highs from the Friday session is a perfect technical analysis signal to start rallying towards the 11,000 level again. As this market is comprised of all of the favorite stocks the Wall Street buys, it makes quite a bit of sense that we will continue to see buying in this market.

The market has found a lot of interest near the 10,500 level, and that of course is worth paying attention to as well. With that being the case, I think that the market is going to eventually find reasons to go higher, and the number one reason to go higher as the Federal Reserve flooding the market with cheap money. If that is going to continue to be the case, then it makes quite a bit of sense that we will see this market rally going forward. After all, we are in an uptrend and the channel has held.

On the other hand, if we were to break down below the lows of the trading session on Friday, then we will more than likely go looking towards the 10,000 level. At that level I would be interested in buying as well because it should be rather supportive. I think at this point we are going to continue to see traders focus more on the Federal Reserve than anything else, but we do have increased tensions between the United States and China so that of course could throw a monkey wrench into the entire situation. That would be short term though, because the Americans and the Chinese need to keep their economies open to each other. With that being the case, markets tend to figure these things out much quicker than the general public, so as the scary headlines fly around the wire, traders will be looking to pick up “cheap technology stocks” in this market, as it has been doing this entire time. Quite frankly, there are only a handful of stocks that are driving most of the indices higher, and that is going to be the case here.