The NASDAQ 100 has shot straight up in the air during the trading session on Monday, breaking above the 10,500 level like it was not even there. This is due to the fact that the NASDAQ 100 is essentially an ETF of a handful of stocks that Wall Street loves. This includes Netflix, Microsoft, Apple, Google, and Amazon. If those companies are going higher, then it is almost impossible for the NASDAQ 100 to fall. After those companies you have Intel and Tesla, so quite frankly the NASDAQ 100 does not offer an opportunity to go short anytime soon. In fact, some of the most professional traders I know do not even bother shorting this market at any point. If it is breaking down rapidly, they might short the Russell 2000, but they would never short this index.

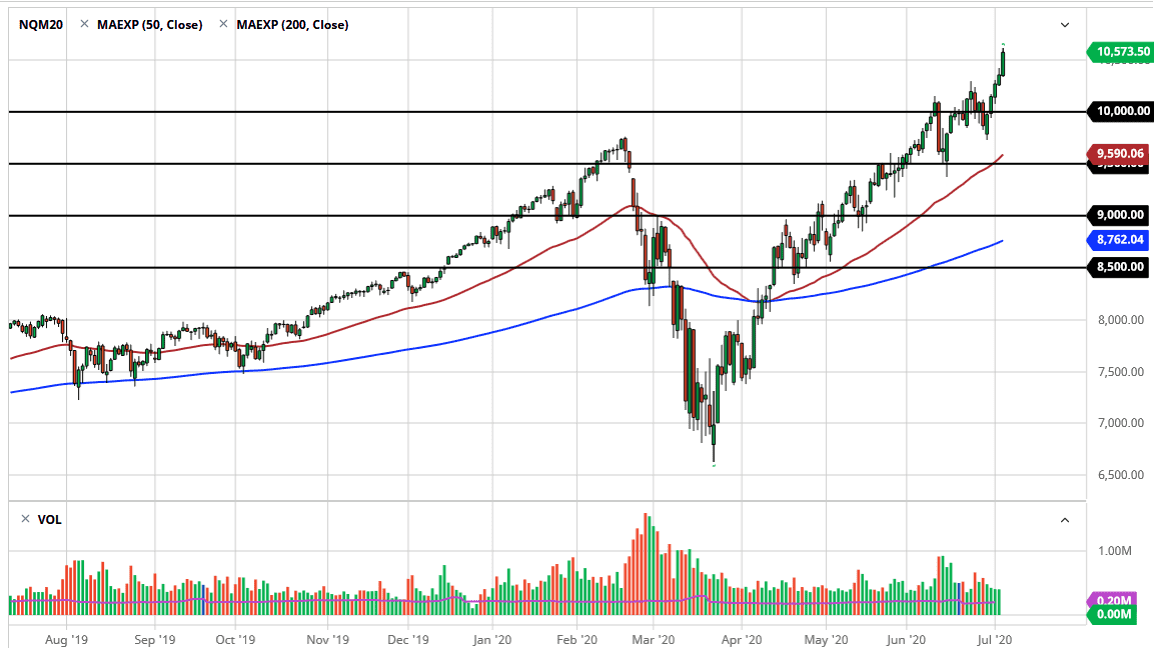

Looking at this chart, I would love to see some type of pullback in order to take advantage of support closer to the 10,000 level, but I do not think we get all the way down there without some type of negativity. If you look at the chart, you can see that there is a channel to be informed and we are essentially at the top of it, so I think a pullback is coming, but I look at that pullback as a nice buying opportunity. Having said that, I would like the idea of finding at least a couple of hundred points lower for an opportunity.

If we break the top of the candlestick at that point, we have gone parabolic and although it could very well do so and take off to the upside, I would be cautious about trying to get long at that point. After all, the market can continue to go higher, but the lesson you want to do is pay once it is gone parabolic. With this, it is more than likely going to continue going higher but pulled back in a rather wicked manner. There are plenty of reasons out there to think that the NASDAQ 100 could get spooked, but longer-term I just do not see how it happens to change the overall trend. If it does, then as I stated previously, I would be shorting the Russell 2000, not the NASDAQ 100. As long as that is the case, I am looking for value but right now I just do not see it as we have gone too far to “chase the trade.”