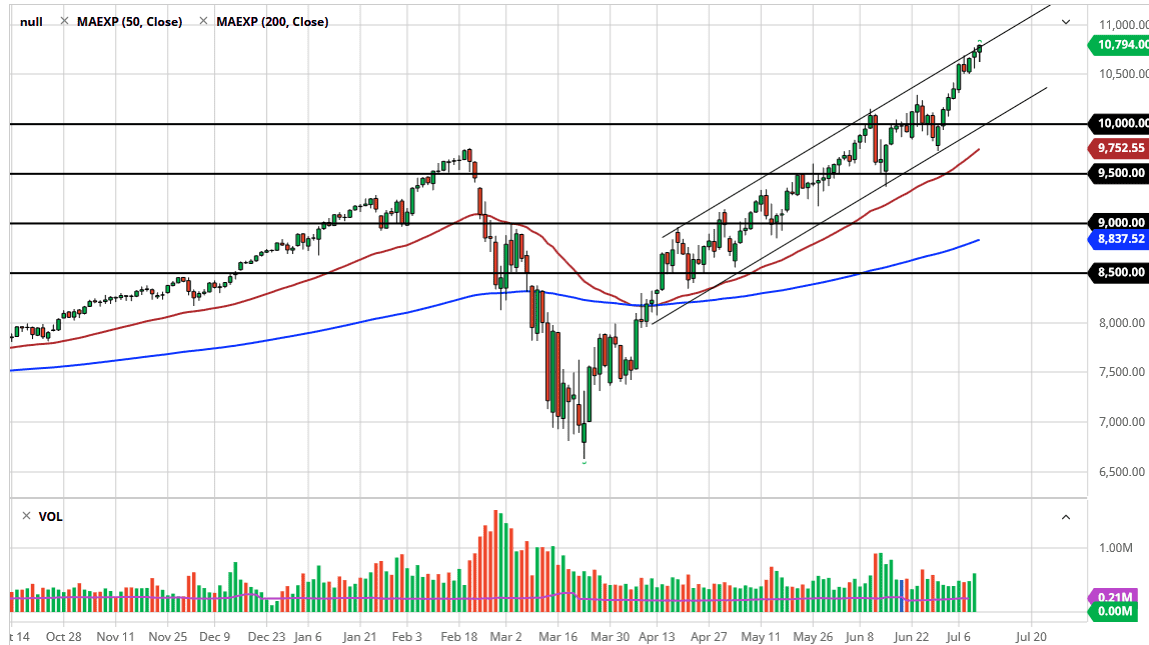

The NASDAQ 100 initially sold off during the trading session on Friday, as it has been a bit of a stretch for a while. However, old habits die hard and it appears that all of the traders out there continue to buy the same stocks, pushing this index higher. Remember, this is essentially an ETF of Microsoft, Alphabet, Amazon, Apple, and Netflix. Those companies make up almost 40% of the index by themselves. Those are the companies that everybody loves and furthermore some of these companies are in the hundreds of ETF products, meaning that just about anything you buy is going to push the value of that particular company higher.

There is a tale underneath which shows just how much support there is, but I think at this point we are getting stretched to the point where it is getting a little bit absurd. We are heading into the earnings season a bit overvalued, so I would love to see some type of massive selloff in order to take advantage of the value. The 10,500 level will be an area where we could see a lot of interest, which is a large, round, psychologically significant figure and an area that has held up quite nicely. Breaking down below there could send this market looking towards the bottom of the overall channel, meaning that we could drop a couple more hundred points. That would be great, but at this point, it does not seem like it is going to happen. Every time it looks like we are going to get a bit of a pullback, Wall Street buys it all up again.

That being said, this cannot go on forever so at the very least I would be looking for a pullback towards the 10,500 level. That would be the absolute minimum I would want to see on a pullback that I take advantage of. If we break to the upside, at this point I would be so uncomfortable about buying this market that I would simply step to the sidelines, although I am more than willing to admit that this market could very well do that on Monday. We desperately need a pullback, and even if we do pull back, I am not willing to sell this market. We need some type of value to present itself. If you are already long of this market, a stop-loss behind the candlestick from the Friday session makes quite a bit of sense.