The NASDAQ 100 fell initially on Tuesday, as one would think due to the fact that it had been so ugly on Monday. However, the bubble continues as we see traders jump in and buy the same handful of stocks. The NASDAQ 100 is heavily weighted in favor of Netflix, Google, Alphabet, Microsoft, and Amazon. These are all the companies that people run to because of their balance sheets, so it is difficult to imagine a scenario where this index sells off drastically, at least for a sustained amount of time. Ironically, it is the very fact that those companies make up roughly 35% of the index that it is somewhat thought of as a safety play when things go wrong. It is a bit counterintuitive to people who have been trading form more than the last year.

However, most of those headline companies have a vested interest in a technologically connected world, which is perfect for the coronavirus situation we are in right now. Working from home, social distancing, all of that favors these types of corporations. Beyond that, even if we do open back the economy to the way it once was, these are all companies that are strong begin with anyway.

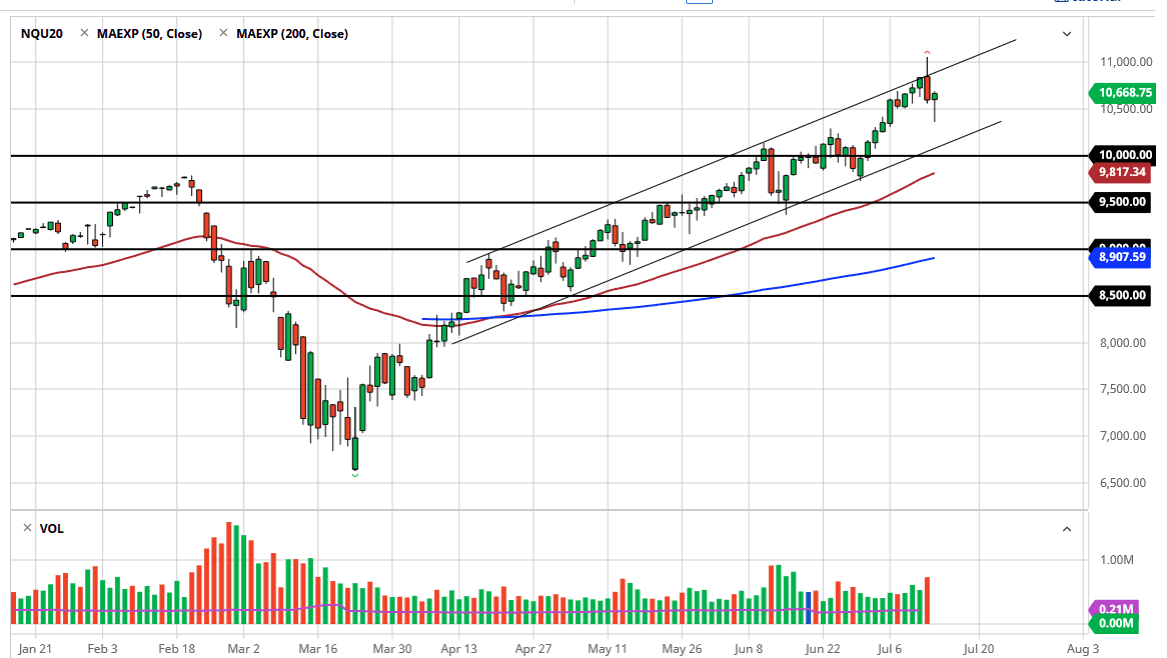

Looking at the chart, we have been in an uptrend and channel for some time, and therefore I had said yesterday that we may get a bit of a pullback towards the bottom of it. We tried to do that during the trading session on Tuesday but fell short and now it looks as if the 10,500 level is going to offer a bit of support. We may simply go sideways in the short term, trying to kill time before taking off to the upside again. If we get that, then everything is fine, and it is just a “pause that refreshes.” On the other hand, if we pull back to the bottom of the channel that is a much more technically attractive move and will get a lot more value hunters into the picture. Either way, I do not have any interest in shorting this market as too many cult stocks swing way too much leverage and influence in this index. Quite frankly, this index starts falling apart, I would be short of the Russell 2000. After all, those are all small caps and people are not as married to those positions.