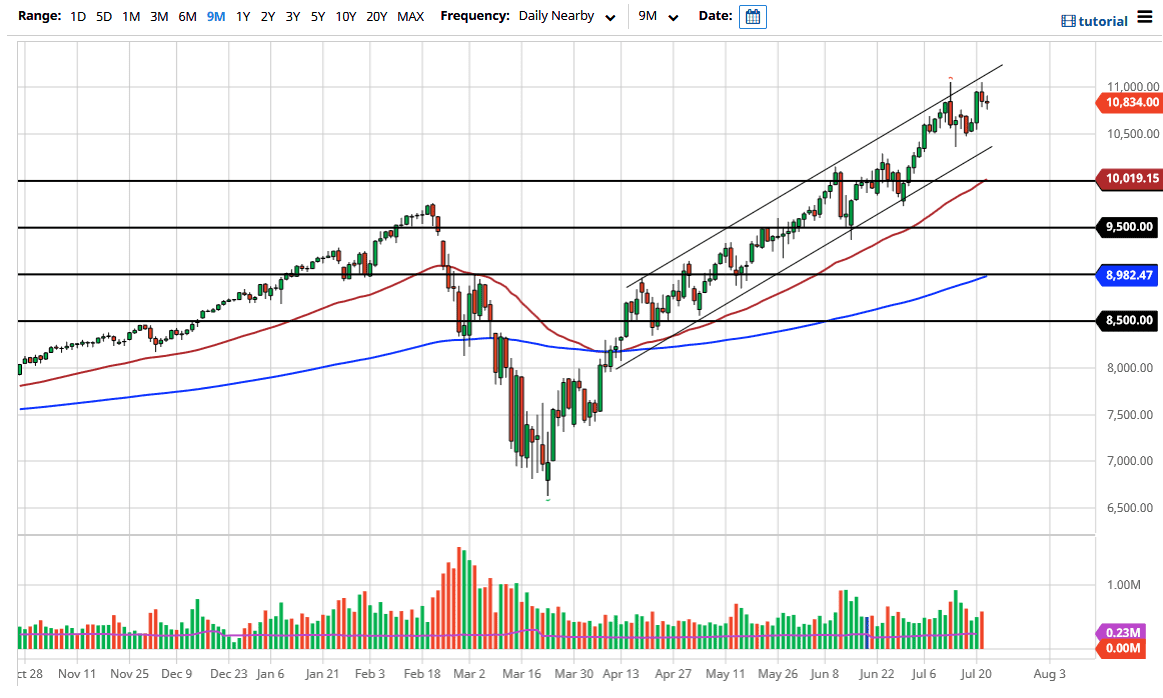

The NASDAQ 100 went back and forth during the trading session on Wednesday, as we continue to look very likely to find buyers on dips. This perhaps was with the 10,500 level being a short-term floor, not only due to the fact that we had seen buyers there but the fact that the uptrend channel dissects through there yet again. With this, I think it is only a matter of time before we see traders looking to pick up a bit of value in the NASDAQ 100 as it has been the favorite trade of Wall Street.

The NASDAQ 100 is heavily weighted towards the stocks that everybody buys on Wall Street such as Tesla, Intel, Microsoft, Amazon, Google, and Apple. Just those stocks alone are roughly 40% of the index, so as you can see it is going to be difficult to break this index down. However, as we are a bit extended it would make sense that we pulled back to find value. Furthermore, you should keep in mind that we are in the midst of earnings season so that could have an effect on the market.

Even if we break down below the 10,500 level, I am not willing to short this market as I believe that the 10,000 level will be even more supportive. That is an area that is a large, round, psychologically significant figure and also features the 50 day EMA. Both of those are reason enough to go long, and it would be an excellent entry if we get the opportunity. After all, Wall Street is running on Federal Reserve money more than anything else, so even if we do get some type of extensive pullback, it will be squashed by the “the Federal Reserve has our back” narrative again. With that being the case, I think we will eventually break above the 11,000 level. Once we do, that opens up a move towards the 12,500 level over the longer term. In general, I do not really have a scenario in which I’m willing to sell the NASDAQ 100, because it is so heavily favored by Wall Street in general and has traded so nicely in a 45° angle.