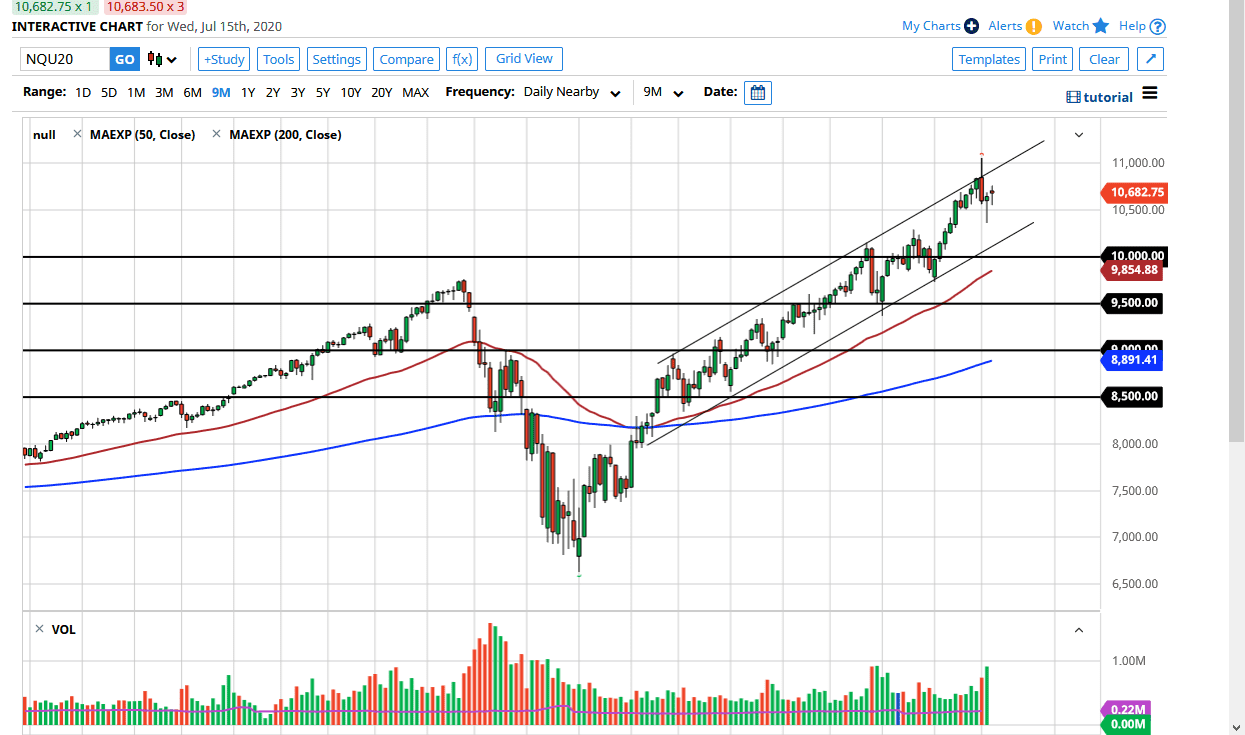

The NASDAQ 100 initially gapped higher during the trading session on Wednesday, rallied a bit, and then broke down quite drastically. However, you can see that the market has shown itself to be extraordinarily bullish, as we recovered almost all of those losses. We ended up forming a bit of a hammer, which was preceded by another one, which is obviously a very bullish look. With that in mind, I think it is only a matter of time before buyers will go looking towards the NASDAQ 100 yet again.

This is a simple matter of liquidity and the fact that money is being forced into the markets. If you are going to invest in companies right now, there is a really good chance that you will buy some type of passive investment strategy. There are literally hundreds of funds that feature stocks that make up a bulk of this index. Such as Netflix, Google, Facebook, Microsoft, and Amazon. In other words, this index has a really hard time breaking down unless the entire market is losing its mind. That does not mean it cannot, but it looks to me as if the 10,500 level has offered enough support to convince buyers to come back in.

I was watching it when it got close to the 10,500 level, and the sellers really pressed the issue but clearly did not have the wherewithal. At this point, I think this is a simple “buy on the dips” type of scenario. I hate being that simplistic about it, but we have been in an uptrend for ages, and we even have a clear uptrend channel from which to trade. Ultimately, I do think that this is only a matter of time before we reach towards the highs again, and probably break above there.

In fact, I do not really have a scenario where I am looking to short this market, but the first thing that would catch my attention is if we were to break down below the 10,000 level, something that would take a significant move to make happen. Yes, we recently had a scare just a couple of days ago, but we have seen that movie before. As passive investing continues to be the way forward for most traders, there is no real catalyst for this index to break down for the longer term.