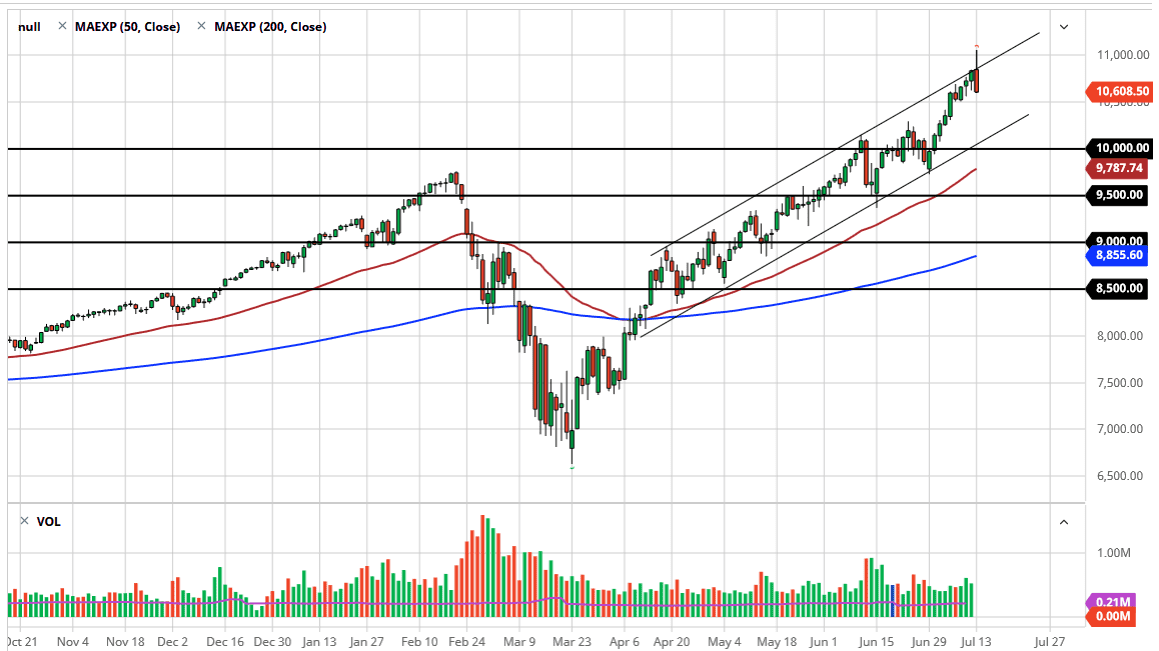

The NASDAQ 100 has initially tried to break above the top of the channel that we have been in for some time but gave back the gains during the day on Monday. By doing so, the market looks extremely negative and it looks like it is trying to fall apart. If we can break down below the 10,500 level it is likely that we will continue to go much lower but would also offer value in a market that has been way overbought for some time. The bottom of the channel is closer to the 10,200 level, so I think that is probably where the buyers will return. That being said, the best trade is probably to simply wait for some type of value to present itself and start buying again. Despite the fact that we formed a horrific-looking candlestick for the Monday session, the reality is we are still very much in an uptrend and were just simply correcting an overbought condition.

Tesla was the main culprit, as it had a massive spike higher and then rolled right back over to show signs of massive exhaustion. Remember, Tesla is a cult stock, meaning that enough people pay attention to it that it has an influence on the entire NASDAQ 100. Furthermore, the NASDAQ 100 is skewed to just a handful of stocks, so really it does not take much to spook this thing. That being said, most days it does not take much to send it higher either, so that is why I do not short this index under 99% of conditions that we will find ourselves in.

I believe that the key right now is going to be 10,500 just below because we will either bounce from there or we will not. If we do not, then I will be looking to buy this index closer to the bottom of the channel which has served us so well for so long. Below there we would have the psychologically important 10,000 level. If we were to crack below that then you need to start asking questions but quite frankly, I think it is easier to short other risk-related assets than the NASDAQ 100 as it “does not play fair.” With this, I am watching and waiting for an opportunity to pick it up “on the cheap.”