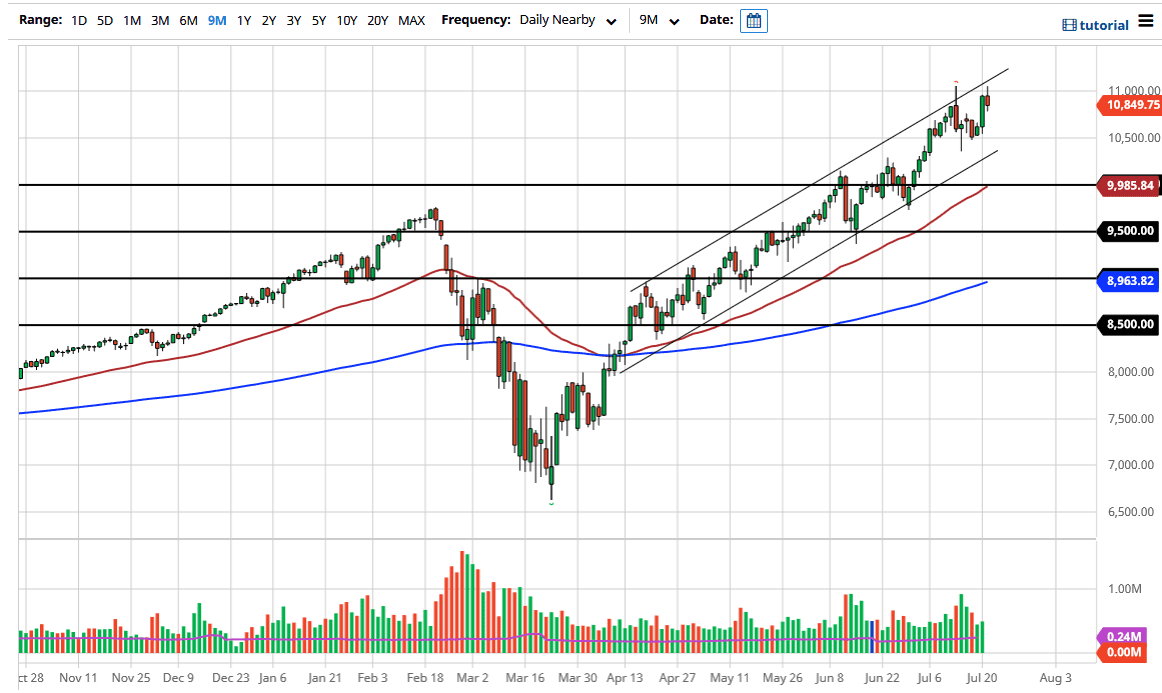

The NASDAQ 100 initially broke above the 11,000 level during the trading session on Tuesday but pulled back significantly to form an exhaustive looking candlestick. Ultimately, I think that the market is likely to go looking for value and support underneath, and I do think that it is only a matter of time. I look at the 10,500 level underneath as massive support area, and I admit that the NASDAQ 100 was a little bit overbought going into this session, so it is not a surprise that 11,000 continues to cause resistance. Furthermore, we are at the top of a major channel, so at this point, it makes sense that we pullback.

If we do break down below the 10,500 level, we will then test the bottom of this channel, which is just below there. This is an uptrend and a very strong and reliable one at that. Ultimately, this is a market that I think will continue to see buyers on dips, because remember there are only a handful of stocks that are pushing the markets higher in general. Those are all represented quite nicely in this index, so look for some type of value on these dips.

On the other hand, if we break above the top of the candlestick for the trading session on Tuesday, that could accelerate the move higher, but again I think it is easier to simply pick up value every time this market dips because it has been so bullish for so long. I find it difficult to find a reason to short this market, and at this point, it is a fool’s errand to do so. If we do rally to the upside it will probably be rather explosive but will also run into a lot of exhaustion eventually.

As long as the Fed is there to pick everybody out, it is difficult to imagine that stock markets will fall for any significant amount of time. I like the idea of looking at the 10,000 level underneath as being the absolute trend defining level. Until we were to break down below there, I would not be concerned at all about this market and look at any pullback from here as a simple matter of a trend continuing the back and forth grind that we see over the long term anyway.