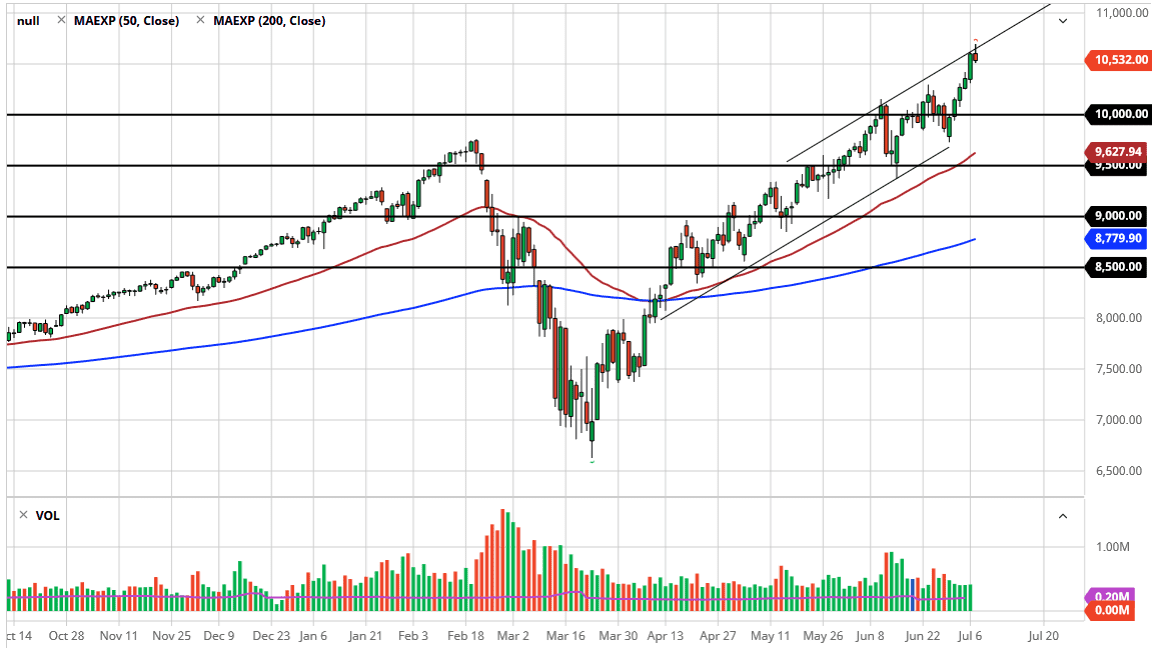

The NASDAQ 100 initially tried to rally during the trading session on Tuesday, as we continue to look very bullish. However, the market is likely to see a lot of selling pressure in this area as we are at the top of an overall channel, and that is something that the market has been paying attention to for some time. That being said, we are overextended, and I think that a little bit of a breather is probably necessary at this point.

At this point, I believe that if we break down below the 10,500 level, it is likely that the market will go looking towards the support levels underneath that are so prevalent on the chart. With this, the market is more than likely will go looking towards the 10,250 level, and then possibly even as low as the 10,000 level. The 10,000 level is a large, round, psychologically significant figure, and the scene of a major breakout. Furthermore, by the time we get down there, it is likely that the uptrend channel will reach that general vicinity.

The alternate scenario is that we break above the top of the candlestick, and then go looking towards the 10,750 level, possibly even the 11,000 level. That of course is an area that will cause a certain amount of psychological resistance, so it is likely that we would see a pullback from there as well. Nonetheless, the market is going to continue to pay attention to the same stocks that they always have, including Microsoft, Google, Amazon, Facebook, and a few others including Tesla and Netflix. Those of the cult stocks of Wall Street, so it is only a matter of time before buyers would step back into try to take advantage of cheaper levels. As soon as that happens, the NASDAQ 100 will more than likely continue to show up. With this being the case, I think it is only a matter of time before the market is going to find value and therefore jump all over this market. We are obviously in an uptrend and I do not see that changing as long as the Federal Reserve is willing to bail out the market every time, we have a small pullback. If we break down below the 50 day EMA, then we may have a longer-term “reset”, but I do not see that happening anytime soon.