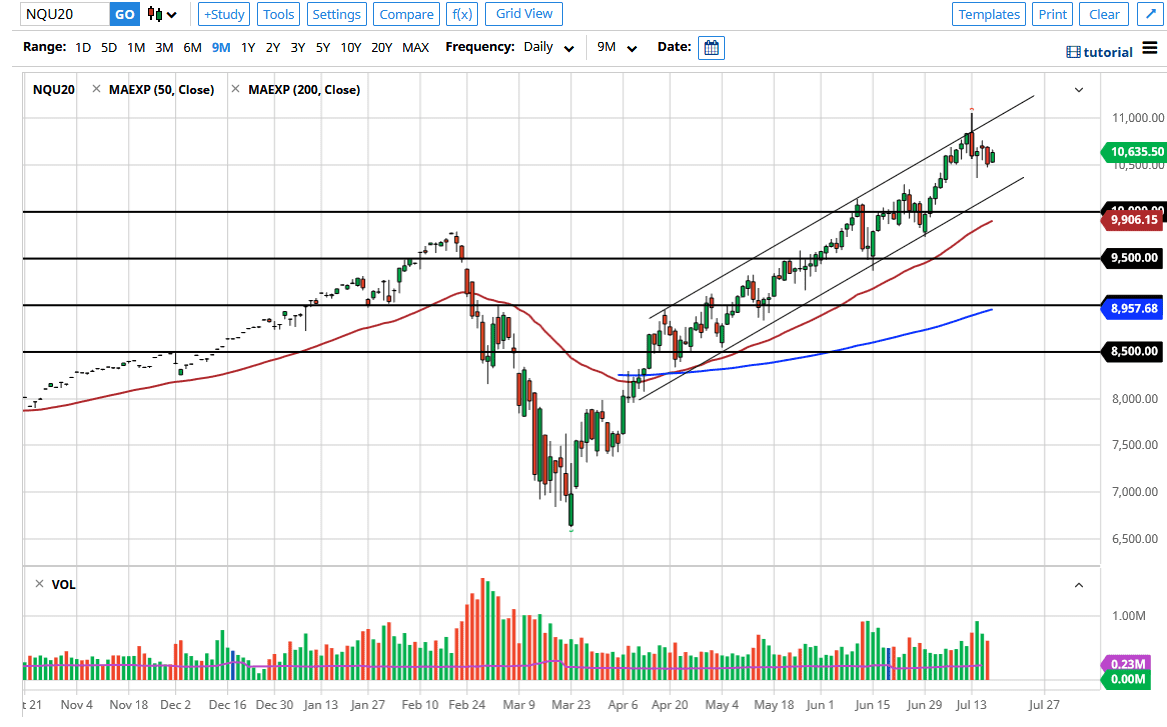

The NASDAQ 100 rallied a bit during the trading session on Friday, as the 10,500 level continues to be important. That is an area that has been crucial more than once so it makes sense that we would hold up there. After all, the US dollar is getting hit hard and that is typically good for stocks. Furthermore, this is an index that is highly influenced by the same old stocks everybody in the world wants to own: Microsoft, Netflix, Amazon, Google, and Apple. That is almost 35% of the index, so at this point in time, it is difficult to imagine that this index will be able to fall for any significant amount of time.

If that is going to continue to be the case, then I think this market will be somewhat artificially lifted. Even if we were to break down below here, the uptrend line at the bottom of the channel will offer support as well, so at this juncture, I would expect to see a lot of buyers jump in and as well. Below there, then we have the 10,000 area that is a large, round, psychologically significant figure and of course had previously been resistance. The 50 day EMA sits just underneath there, offering quite a bit of support as well. It is not until we break down below the 50 day EMA that I start to look at the possibility of shorting.

To the upside, I believe that the 11,000 level will be targeted, but it might take a little bit of time to get there. We are in the midst of earnings season as well, so that could cause a bit of volatility so keep in mind that if we break down it could offer a little bit of a buying opportunity based upon value. We did see Netflix get hammered after hours on Thursday which could have led to that, but it recovered quite rapidly. The channel that we have been in has been extraordinarily reliable, so at this point, I think there is no argument to be made for shorting this market anytime soon. If we do break above the 11,000 handle, then it looks like the 12,000 level will be targeted given enough time and will probably take several weeks to get there.