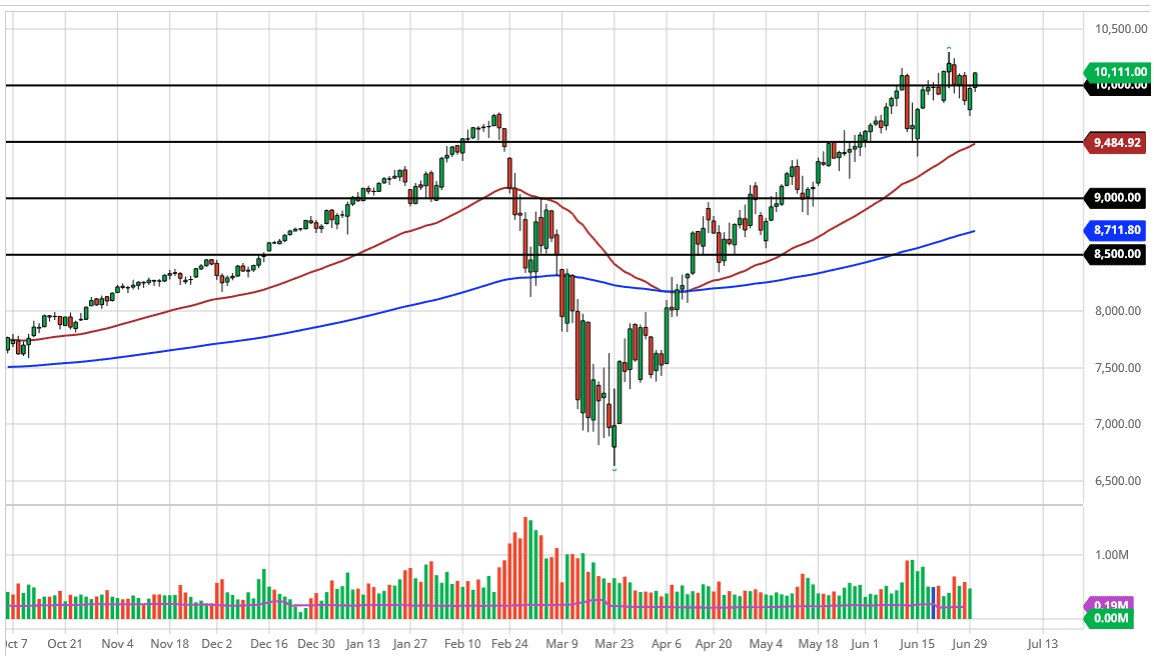

The NASDAQ 100 has shown itself to be resilient, breaking through the 10,000 level. By doing so, the market is likely to go looking towards the all-time highs again, which is not that far away. I like the idea of buying pullbacks and therefore I am very bullish of the NASDAQ 100 going forward. The 50 day EMA has offered a bit of a trend line of sorts, and it certainly looks as if there are plenty of buyers underneath. All things being equal, I do think that we reach the all-time highs and continue to go higher. The $10,500 level could be targeted, and although I do think that happens, it is probably going to take a bit of time to get there. I think we continue to “buy on the pullbacks” and chop back and forth.

I think it is going to be very noisy, but quite frankly the market is continuing to move based upon the latest headline, which of course is how the market has been trading for some time. When you look at this chart, you can see that there is a bit of an uptrend and channel that we have been following, and I think it is only a matter of time before that happens to show itself yet again.

Keep in mind that the NASDAQ 100 is comprised of a handful of stocks that everybody and Wall Street loans, including Alphabet, Microsoft, Facebook, Netflix, and Amazon. All things being equal, the market is also paying attention to those handful of stocks just below, such as Tesla. In other words, the “groupthink” on Wall Street continues to plow into these major stocks, and with just the handful that I have mentioned making up almost 40% of this index, you can see why we would go higher.

Looking at this chart, we have had a couple of strong days after an initial gap lower on Monday. This shows that the market is ready to continue going higher, as it has shown quite a bit of strength. Looking at short-term charts, I like the idea of buying pullbacks, so therefore I would drill down to those lower time frames in order to pick up bits and pieces. I have no interest in shorting the NASDAQ 100, because there are so many of the household name stocks that people are willing to jump all over.