The NASDAQ 100 initially dropped a bit during the trading session on Wednesday, but then turned around to show signs of life again. As the stock market awaits the result of the jobs figure, it is possible that we could see a bit of a “no matter what happens we rally” type of moment. This might be because we are looking at the possibility of traders looking at a poor jobs number as a sign that the Federal Reserve will continue to step in and support the market even further, which is what has lifted the stock market more than anything else over the last 12 years. A stronger than anticipated jobs number will probably make people begin to bet on the US recovery. Either way, it is highly likely that bullish attitudes will prevail given enough time.

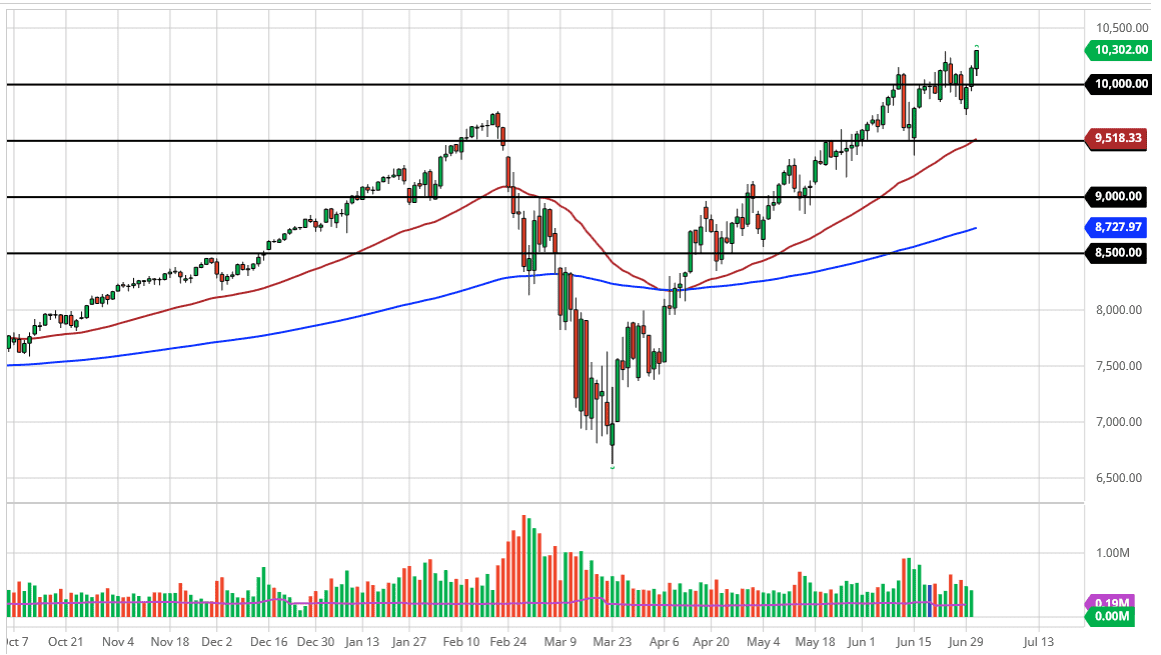

On the idea of a pullback towards the 10,000 level, I think there should be plenty of buyers, and therefore I think that we will see plenty of buyers paying attention to that large, round, psychologically significant figure and the previous buying pressure there. That would be a roughly 50% retrace of the most recent surge higher, so it all kind of lines up nicely. Even if it does not work out that way, I think there are plenty of buyers underneath willing to get involved. When you look at the chart, you can also see that the 50 day EMA underneath is crossing the 9500 level, which for me is the “floor” in the uptrend. After all, we have been forming a significant uptrend and channel for some time, and therefore it all lines up perfectly there. Short-term pullbacks I look at as buying opportunity and I have absolutely no interest in shorting the NASDAQ 100 unless something drastic happens. It would take a significant shift in attitude in order to make that happen, not something that I see in the short term, but we can always have some type of black swan event. In the meantime, as the index is comprised of the most popular stocks out there, it makes quite a bit of sense that we will continue to see the NASDAQ 100 rally in general. Unless you are willing to bet against Facebook, Microsoft, Amazon, and the like, you are going to struggle shorting this market.