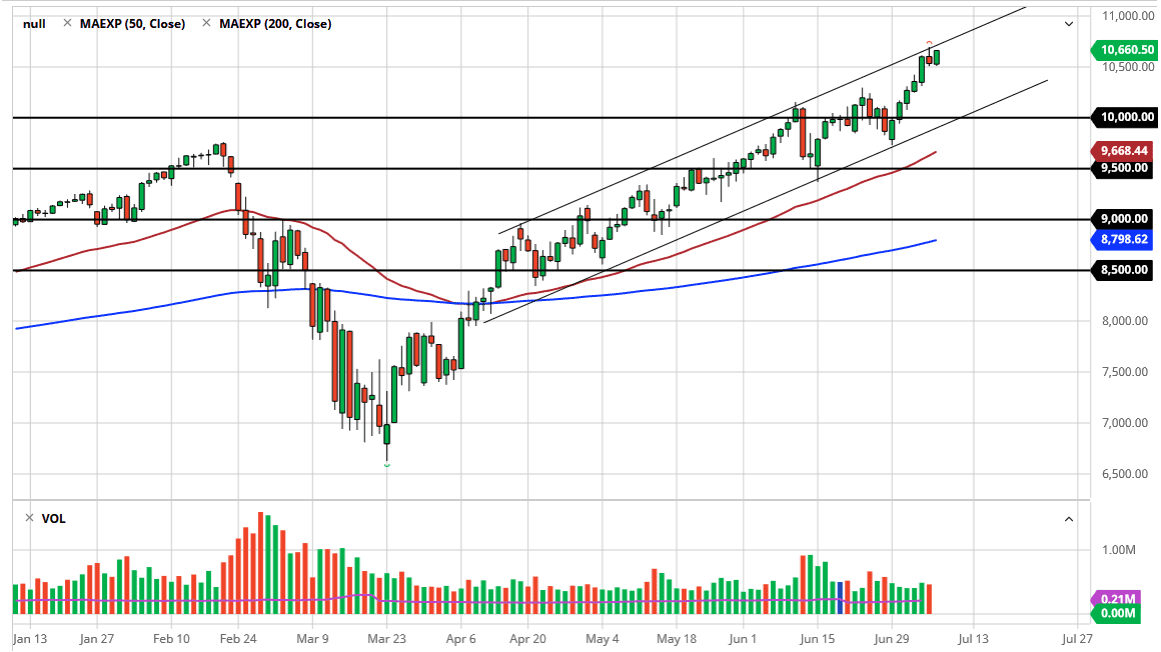

The NASDAQ 100 has shown a significant amount of resiliency, despite the massive amounts of volatility that we see on a daily basis. After all, the market comprises of all of the basic Wall Street go to stocks such as Netflix, Alphabet, Facebook, Microsoft, and Apple. Those stocks are in a huge majority of ETF products, so quite frankly this is an index that can never be sold. As long as there is liquidity out there the question is not necessarily whether or not you should be bullish or bearish of the NASDAQ 100, but whether or not you should be buying or waiting for a pullback. As we are at the top of the channel, I do believe that we are going to see selling pressure but a break above the highs of the trading session on Tuesday, it could represent some type of massive push higher, perhaps sending this market towards the 11,000 level in a bit of a frenzy.

Underneath, the 10,500 level continues to act as support, so if we break down below there, I think we could have a little bit of a “air pocket” to facilitate selling. The market could go looking towards the 10,250 level at that point. Underneath there, the 10,000 level also offers plenty of support, and with the uptrend line of the channel coming into play, then I think there would be plenty of buyers. I have no interest in trying to short this market though, I think a pullback like that would be welcome.

At this point, I am very skittish to buy this market for anything more than a quick “smash and grab” type of trade, probably something along the lines of the day trade. Even if we take off quite drastically from there, I think you will get an opportunity to pick up the NASDAQ on some type of pullback. That would be a longer-term trade, but the momentum may pick up quite drastically. All things being equal, this is a “buy on the breakout” or a “by the pullback” type of scenario. Shorting this market can lead to disastrous results if you are not careful. The fact that we close that the very top of the range during the trading session on Wednesday is an extraordinarily bullish sign. Expect volatility, but this is still a “one-way” trade.