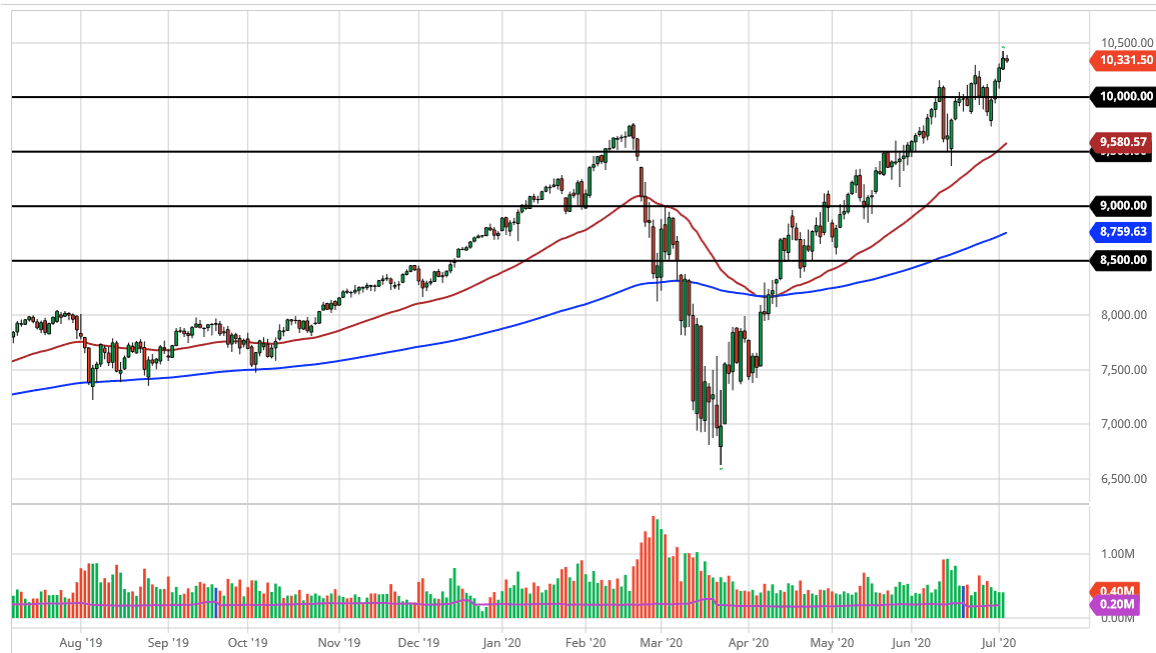

The NASDAQ 100 could pull back a bit going into next week, but at the end of the day the reality is that we are very much in an uptrend. We have been on a channel for some time and although we may be a little bit stretched at the moment, there should be a significant amount of support underneath at the psychologically important 10,000 level. That is an area that obviously attracts a lot of attention, and it is an area that had caused significant pullback pressure previously.

It is likely that we see plenty of support in that area, but even if we break down below there it is likely that we will see buyers underneath at the 9500 level as well. That is where the 50 day EMA is and essentially the bottom of the up-trending channel. Remember that this index is being supported by the Federal Reserve as all it seems to do is jump in and help the market anyway can every time there is a small pullback. The 9500 level has been crucial previously, so that of course coincides nicely with what we are seeing. With the Federal Reserve looking to bail the market out and the NASDAQ 100 being driven by Netflix, Amazon, Google, Tesla, Microsoft, and Apple, (this makes up about 40% of the index) it makes sense that we will only go higher, not lower over the longer term as Wall Street loves all of the stocks. This is the biggest mistake that a lot of retail traders, they think that they are trading 100 stocks. The reality is you are trading about seven.

With this being the case, there is no need to fight the trend, there is nothing on this chart that tells me that any pullback will be anything other than just a pullback, so at this point I do not even have a scenario where I am looking to sell. I may start to analyze this market differently if we break below the 9500 level but barring some type of major jolt to the economic system, I do not see that happening. It is more likely that we touch 10,500 before we touch 9500 as we continue to see this market just grind away, oblivious to anything in the real world.