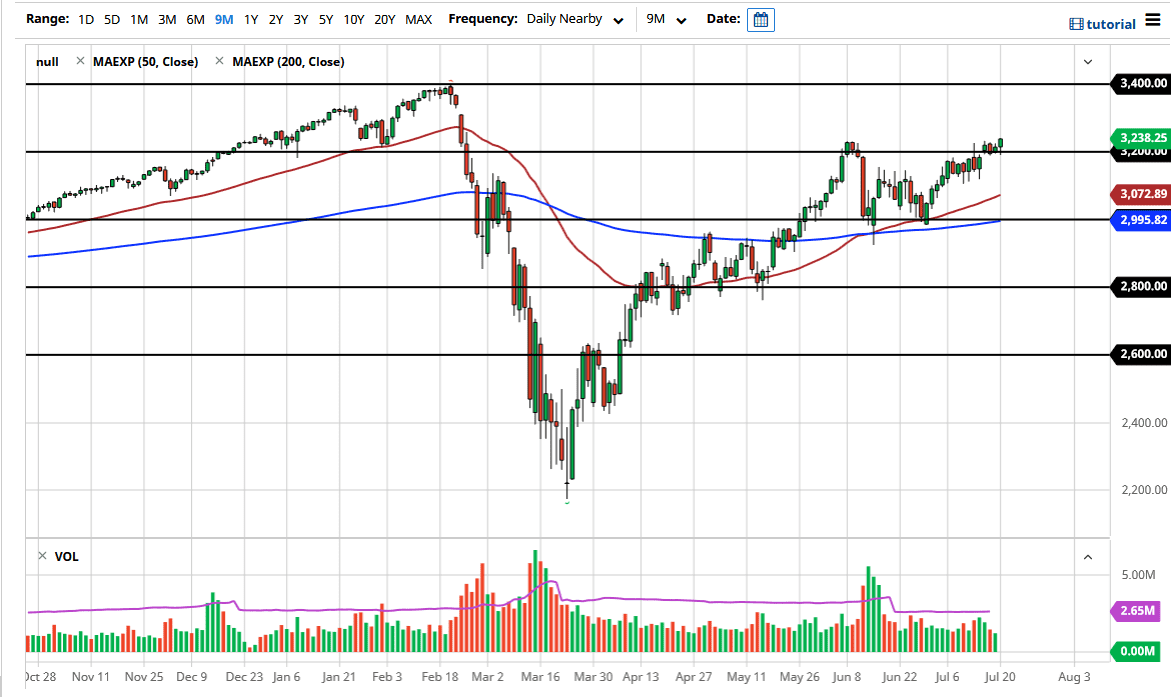

The S&P 500 initially gapped higher to kick off the week on Monday, and pulled back a bit to test the 3200 level, and then turned around to rally yet again. This is a market that continues to rally based upon Federal Reserve quantitative easing and the fact that the Federal Reserve will be there to pick it up every time it drops 5%. The 50 day EMA underneath is starting to turn higher, so I think this shows that trend traders are starting to jump all over this as well. Ultimately, we have broken above that short-term high from May, and now I think it is all but a given that we will go looking towards the gap which is closer to the 3360 handle.

After that, we will almost certainly test the all-time highs and I think with the central banks out there behaving the way they are, it makes quite a bit of sense that the stock markets will continue to attract inflows. The market continues offering plenty of buying opportunities every time we pull back, with the 3200 level likely to offer a bit of a short-term “floor” in the market. Furthermore, there is also a gap underneath the bottom of the candlestick from last week that should continue to offer buying opportunities and supportive action as well.

The 3400 level is the all-time high, and I find it very difficult to imagine that we will not at least try to get there over the next couple of months. It is probably going to continue to be very choppy but we are still very much in an uptrend so there is no point in fighting it. I believe that selling the stock market and the indices is all but impossible right now, as we have seen just how resilient they will be in a loose monetary policy. This has been the case for 12 years, with a few minor exceptions here and there but in the end, it is all about Federal Reserve liquidity more than anything else. Ultimately, the 200 day EMA sits at roughly 3000 below, and that is your ultimate “floor in the market” that would need to be broken below in order to sell. I do not see that happening anytime soon, so again I think this is just simply a matter of whether you are long or if you are on the sidelines.