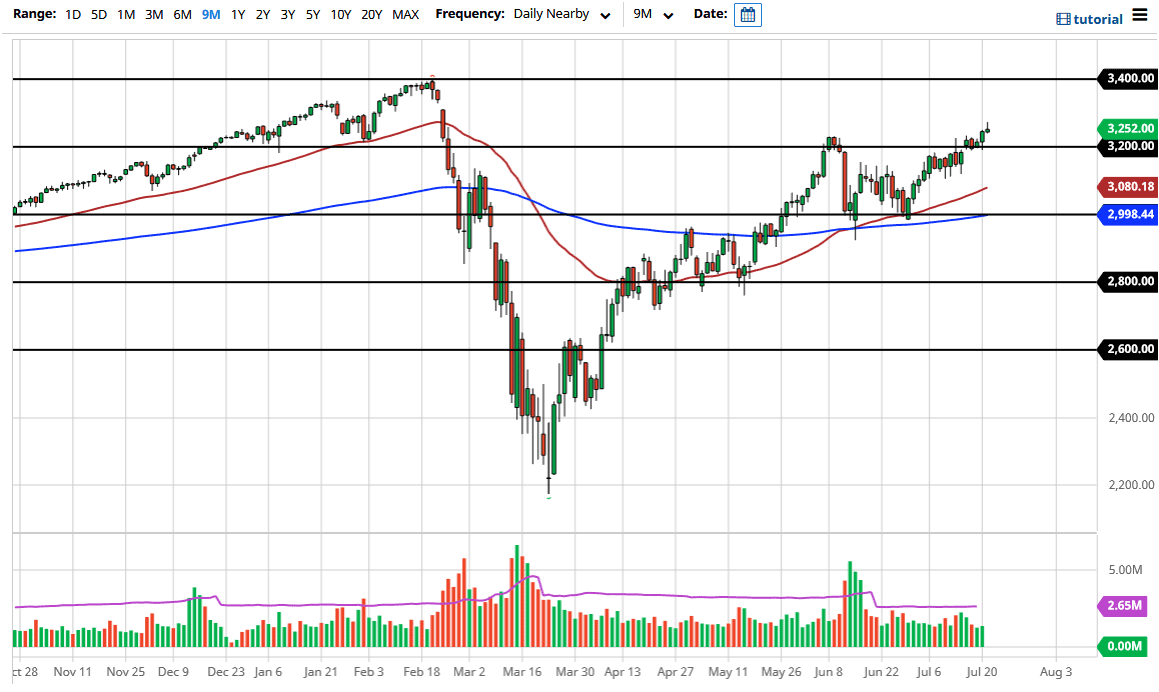

The S&P 500 rallied a bit during the trading session on Tuesday but did give back quite a bit of the gains. Having said that, we ended up forming a bit of a shooting star just above the 3250 level, and at this point, I think we could get a little bit of a pullback. Ultimately, the 3200 level should offer support and I think that there will be plenty of buyers underneath looking to take advantage of what has been a strong uptrend. While we are in the midst of earnings season, nobody seems to care about that as we are focused on Federal Reserve liquidity.

[CAD:EN - 2 - Current volatility is making great stock trading opportunities - dont miss out CTA

]If somebody comes out and shocks the market, it will only offer value at this point. If we can break above the top of the candlestick it is likely that the market goes looking towards the 3350 handle, which is where we see the top of a gap that had recently happened. If we can break above there, then the market goes looking towards the 3400 level which is the “all-time high.” I do think that eventually, the market will try to get there, if for no other reason than to simply test that level.

To the downside, if the market were to break down below the 3200 level, I think there is plenty of support at the 3150 handle, and then the 3100 level. The 50 day EMA is sitting at the 3080 handle, and I think that will be the “floor” going forward. I think it is just a matter of buying dips every time it happens, and it bounces. At that point, it is a sign that the buyers will be tempted to get involved. The Federal Reserve continues to liquefy the markets and throw money into them, so it is almost impossible for them to fall over the longer term. Yes, we could get some type of major breakout, but we have already seen that the Federal Reserve will step in if we lose about 5%.

I know a lot of people are complaining about the fact that the markets are distorted, but you have two choices at this point in time: You can either be correct in your economic process and thought pattern, or you can be profitable. It is that simple, as it has been since 2008.