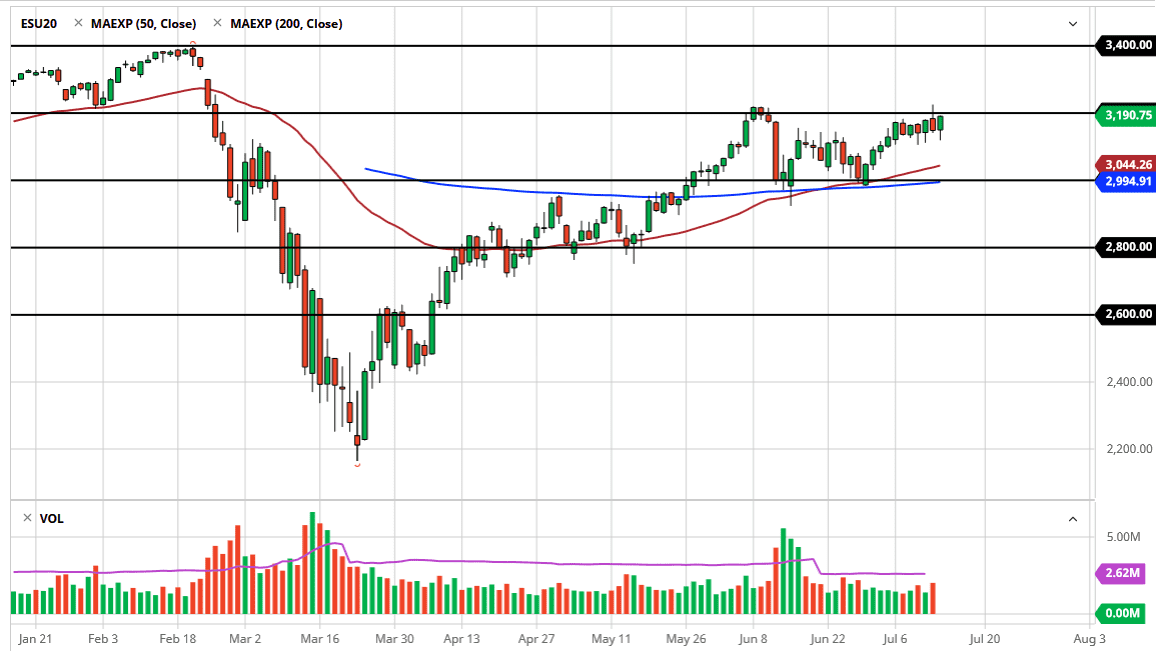

The S&P 500 has pulled back initially during the trading session on Tuesday but found plenty of buyers to shoot this thing straight back up in the air again. That being said, the 3200 level continues to be important, so I think at this point it is going to take something rather special to poke through this area. Once we clear the 3220 level, perhaps even the 3230 level, then we have a longer-term “buy-and-hold” traders coming in to take advantage of what will be a clear breakout and easy path towards the all-time highs again.

We are in the earnings season so there will be the occasional hiccup. In fact, that may have been part of the problem as bank earnings were a bit of a mixed bag. However, we have a lot of volatility and ugly headlines ahead of us due to the fact that the coronavirus numbers are not getting better. As long as there are concerns and threats about the economy locking down, there will be a bit of weight around the neck of the index itself. Regardless though, it is obvious that there are plenty of value hunters on these dips and therefore I have absolutely no interest in trying to short a market that is clearly at worst neutral.

You can make an argument for a consolidation area between the 3000 level and the 3200 level, so that might be your worst case scenario. A pullback from here will probably attract enough buyers towards the bottom of the range to get a bit of a bounce. The 3000 level looks to be rock solid not only due to the fact that the 50 day EMA is sitting above it now, but also the 200 day EMA sitting just below it. I think it is likely that we are going to see choppy and volatile conditions, but earnings season means that people may have a knee-jerk reaction to pull the index lower, which simply offers a nice buying opportunity as the Federal Reserve liquidity measures continue to flood the market and therefore force money into the stock markets in general. Fundamentals do not matter anymore, at least not for anything more than a quick “knee-jerk reaction.” If that is going to be the case, then you might as well play the game in that fashion.