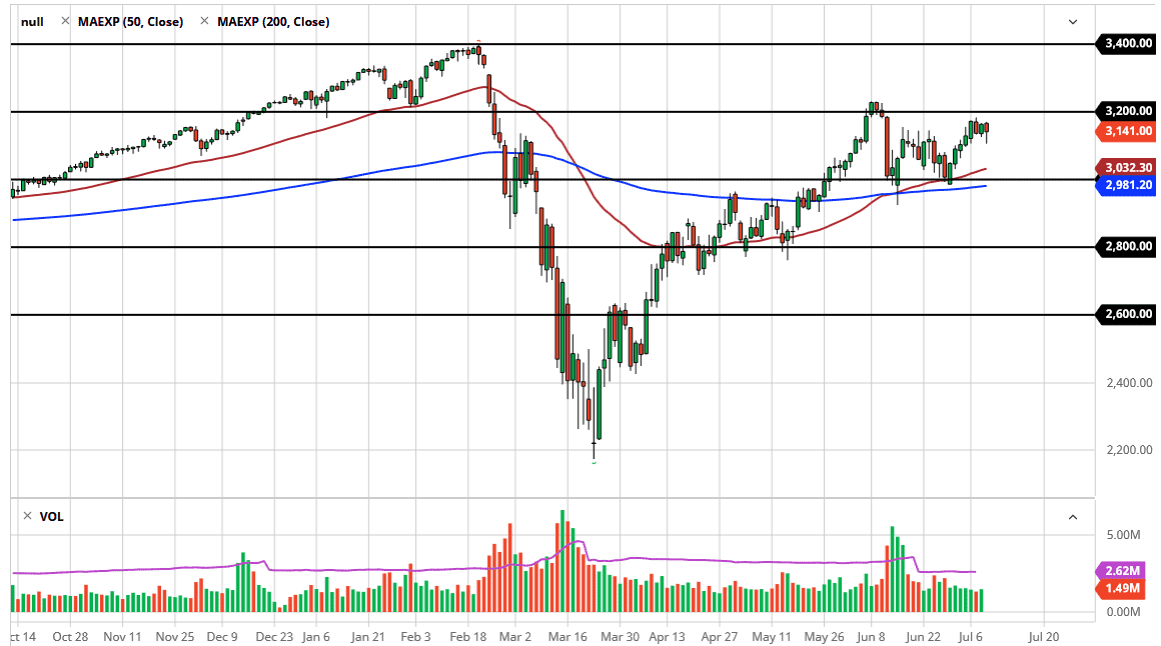

The S&P 500 has fallen rather hard during the trading session on Thursday, but by the time the market closed we had recovered about half of the losses. We ended up forming a bit of a hammer, which of course is a bullish sign. At this point in time I think that short-term pullbacks will continue to look as value for most traders, and therefore I think that the market goes looking towards the highs of the candlestick for the trading session on Thursday, and if we can break above there it is likely we will go looking towards the 3200 level. Even if we do break down below the bottom of the candlestick for the Thursday session, I think there are plenty of areas underneath that could offer an of buying pressure to send this market higher.

From an overall perspective, I believe that the market is currently trading between the 3000 level underneath and the 3200 level above. We are essentially in the upper quarter of the range, and it does look like we are going to try to continue the upward momentum. I would look at short-term pullbacks as potential buying opportunities unless of course we get some type of massive selloff in a volatile moves like we did during the day on Thursday. If that happens today, then simply step out of the way and no that you will be able to buy at lower prices next week.

That being said, if we can clear the 3230 level, then we are free to go looking towards the all-time highs again, closer to the 3400 level. I do think that happens given enough time, but we have earnings season coming, which I think is probably going to be more about the tone of the CEOs around the United States than anything else. After all, we know that earnings do not matter anymore, nor do P/E ratios, or anything like that. At this point we continue to see buyers based upon Federal Reserve liquidity, and I just do not see how that changes in the short term. As there is no return on money in general, people are buying stocks to get away from currency risks, as central banks are killing fiat. This is also why we see gold markets strengthening. It has all the same game; it is reacting to central bank liquidity measures.