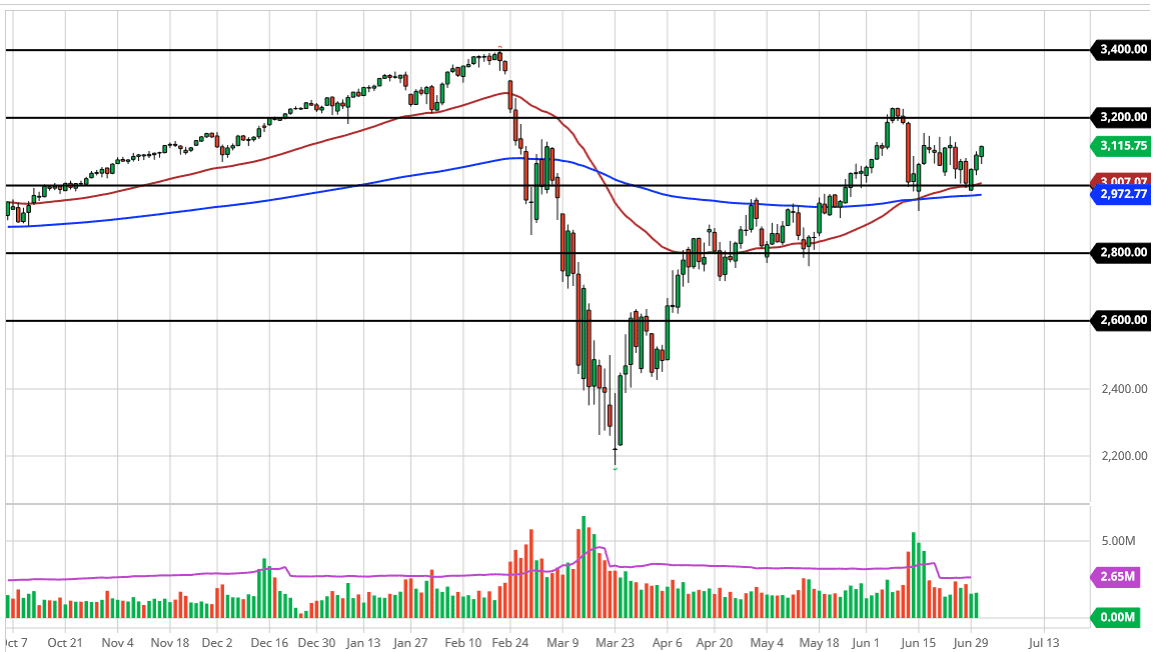

The S&P 500 initially dipped during the trading session on Wednesday but found buyers underneath the turn things back around to break above the 3100 level. By doing so, the market looks as if it is ready to try to break out, as the 3150 level has been massive resistance. However, it is worth noting that we have the Non-Farm Payroll figures come out during the day on Thursday and that will obviously cause quite a bit of noise in general. The S&P 500 has been boosted by the fact that the weighting of the index favor some of the most popular companies in the world, but most importantly it is being lifted by the Federal Reserve. That is not going to change anytime soon, so it is simply a matter of time before this market rallies yet again.

If we were to break down a bit from here, I think the 3000 level would be crucial and therefore it is likely that we would see a lot of buyers in that area due to the fact that it is a large, round, psychologically significant figure, and the fact that the 50 day EMA is starting to cross above there. The 200 day EMA is just below, so I think that general vicinity is going to act as a hard-core “floor” in the market. If we were to break down below there, then it could open up a move down to the 2800 level underneath, so it is highly likely that we will see choppy behavior all the way down to that region. However, the 2800 level should be a supportive level. All things being equal, this is a market that I think people will look at as a market that you need to buy on the dips. After all, as long as the Federal Reserve is willing to bail out Wall Street, it is difficult to imagine a scenario where the stock market can be sold for anything other than a short-term crash. With this, after the job numbers, I will be looking at any dip as a potential buying opportunity, especially if it gets a little bit overdone.

Historically speaking, going into the July 4 weekend, the S&P 500 tends to be very bullish, so I think that may end up being the way we go going forward as well. The Federal Reserve has stated during the Wednesday session that they are going to buy bonds in ad infinitum, so that boosts Wall Street as well.