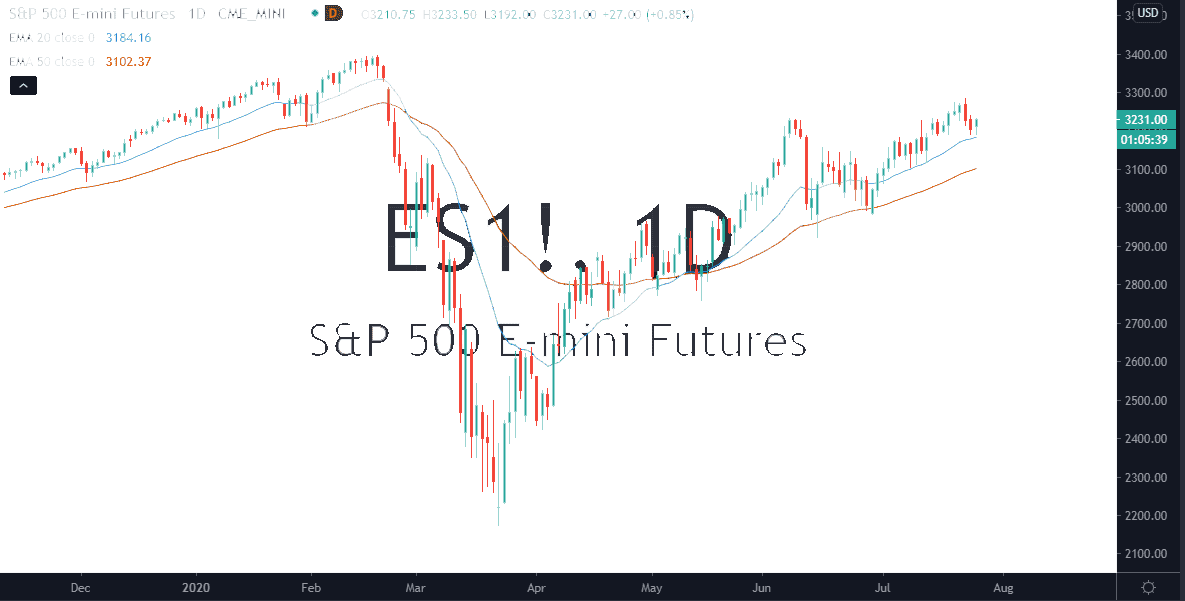

The S&P 500 initially pulled back a bit during the trading session on Monday but then bounced off of the 20 day EMA to show signs of support again. The 20 day EMA has been in a nice uptrend right along with the market, and as you can see, there has been a lot of interest in this indicator. The 50 day EMA is lower and has been just as interesting for traders. The 50 day EMA is currently sitting at the 3100 level, an area of significance and an area that has been quite often looked upon with interest. At this point in time, it is obvious that the S&P 500 is simply a “buy on the dips” type of market. Over the longer term, I think that we will continue to see the Federal Reserve indicate that it is looking to keep monetary policy loose, and that will continue to drive stocks higher.

The candlestick looks like a bit of a hammer, so that does suggest positivity as well. At this point, I think that the market will probably go looking towards the 3300 level, maybe even all the way to the 3400 level where we had seen the all-time high recently. I think at this point we are likely to see a lot of noise, but ultimately this is a market that is dealing with the noise of earnings announcements more than anything else. That will cause the occasional pullback, but the Federal Reserve liquidity measures are without a doubt the only thing that will matter in the long run.

I think eventually we get to the all-time highs, but that does not mean it is going to be easy to get there in the short term. Expect a lot of noise but shorting the S&P 500 is all but impossible at this point. Simply look for value and take advantage of it as this market has been in an extremely bullish run for quite some time. Ultimately, I think we will not only get to the all-time highs, but we will probably continue to go even further. The Federal Reserve will do everything it can to bail out Wall Street at the first sign of trouble, as has been proven more than once over the last decade. I hate saying it, but the game is most certainly rigged, and it is rigged to the upside.