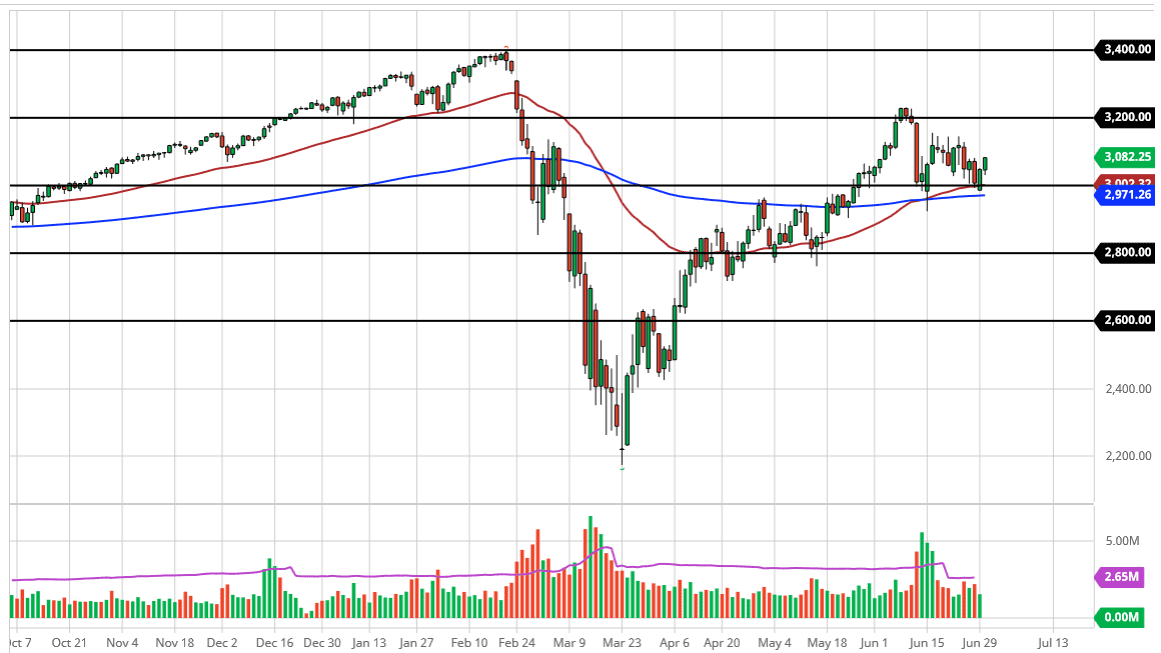

The S&P 500 has rallied significantly during the trading session on Tuesday, breaking towards the 3090 handle. This is a market that is likely to continue to see buyers on dips, and I think that the 3150 level will probably be targeted. With that in mind, I like the idea of buying short-term pullbacks as it gives us an opportunity to pick up value. I think that the market has plenty of support underneath, so I do not have any interest whatsoever in trying to short this market.

The 50 day EMA underneath at the 3000 level will offer a bit of support, not to mention the fact that the 3000 level is a large, round, psychologically significant figure that would cause quite a bit of attention. The 200 day EMA is just below, so at this point in time it is likely that there are buyers underneath in that area as well. Ultimately, this is a market that I think will continue to grind higher, and I would look at these pullbacks as value that needs to be jumped on. The 3150 level is an area that has offered resistance previously, and therefore it is likely to see a lot of action. If we can break above there, then it is likely we go looking towards the 3200 level.

If we break above the 3200 level, then it is likely we continue to go much higher as it was the most recent high and we had seen a lot of selling from that level previously. Most likely, I suspect that we are going to see this market go back and forth, killing time in this area as we try to figure out whether or not the fears of economic recession takeover, or if we are simply going to pay attention to the liquidity coming out of the Federal Reserve. I suspect that the latter of the two will probably come out on top, but that does not mean that it will not be noisy. We also have the jobs number coming out the next few days, so that could keep a bit of a cap on this market, but once we get past that announcement, we could then see quite a bit of buying pressure. If we break down below the 200 day EMA, I will “reset”, and take a look at whether or not there is a new trade.