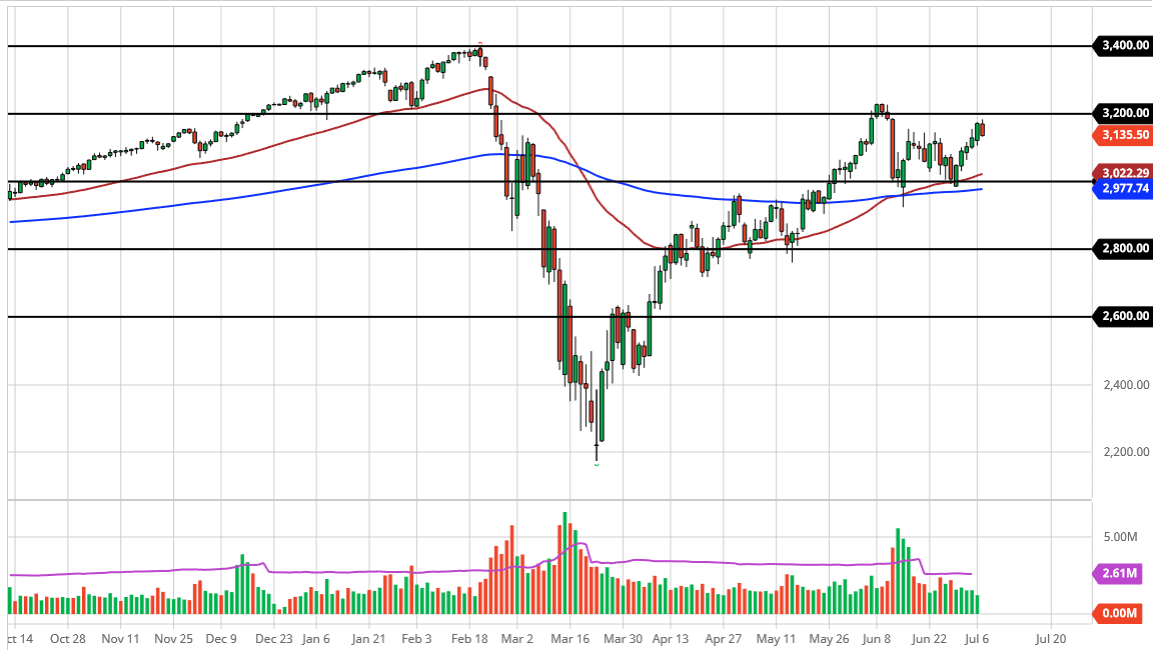

The S&P 500 initially tried to rally during the trading session on Tuesday as we continue the overall uptrend. However, we did pull back towards the 3130 handle, which is an area that was previously resistant so it will be interesting to see whether or not we bounce from here. To the upside, the 3200 level is likely to be targeted and I think that the short-term pullback is more than likely going to be thought of as value in a market that has been very bullish.

The 50 day EMA underneath is closer to the 3000 level, and it is a large, round, psychologically significant figure as well so I think it is only a matter of time before the buyers come in and pick this market up. The market is currently testing a 200 point range in general, and with that being the case I think we will eventually try to touch the top of it. If we can break above the 3200 level, and perhaps even the 3225 level, then the market is likely to run towards the 3400 level. That is an area that has caused a significant amount of resistance and previously had a pretty decent selloff, so at this point, it makes quite a bit of sense that we would struggle. Once we break above there, then it is likely that we will see the market reach towards an all-time high, something that I do anticipate seeing given enough time.

If we were to break down below the 200 day EMA, it is likely that we will go looking towards the 2800 level underneath. This is a market that I think ultimately will find plenty of buyers, as the Federal Reserve is more than likely going to continue to throw money at the markets as they always do. The Federal Reserve is here to protect Wall Street, and their actions over the last 12 years have certainly proved that. I do not think that selling these indices are possible anymore in the way the markets are structured, and with the way that the indices are weighed. At this point, I do not know where the market can be sold, at least not anytime soon. I do like the idea of finding value and taking advantage of it.