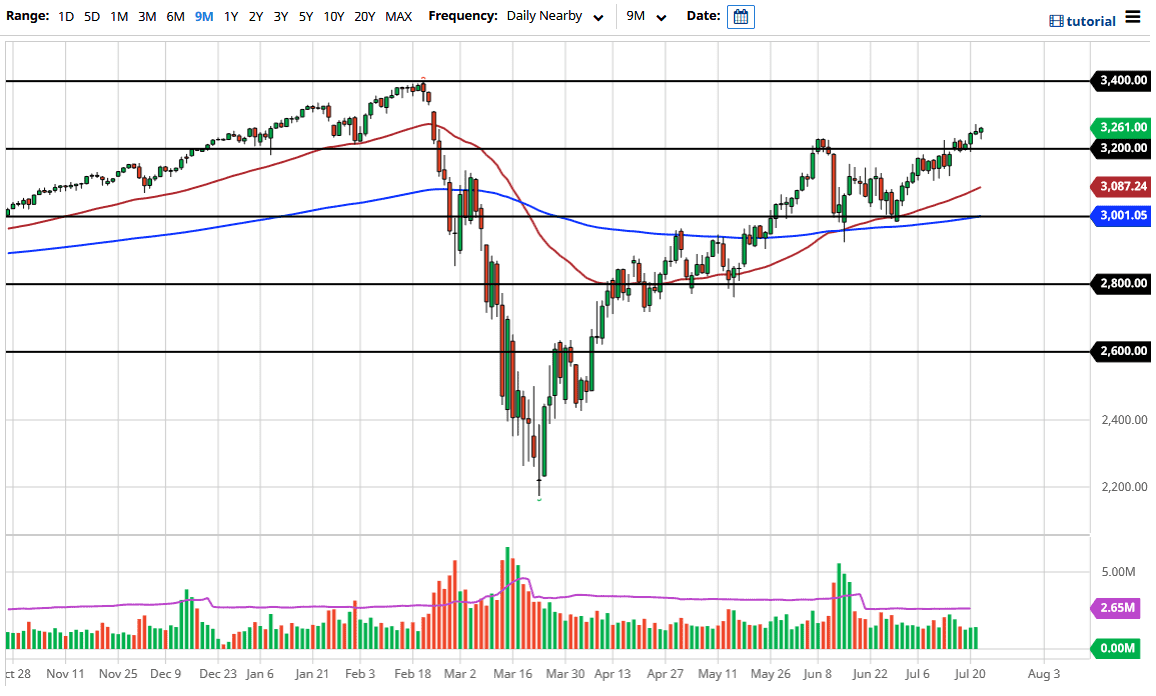

The S&P 500 initially pulled back a bit during the trading session on Wednesday but found buyers underneath to turn things around and show signs of strength again. Ultimately, I think that this market is going to go looking towards the gap near the 3050 handle, so I am a buyer of dips. The fact that we closed towards the top of the range suggests that we may eventually break above the top of the shooting star from the previous session, which is a very bullish sign. At that point, I am a buyer and I do think that we continue to grind to the upside. However, we could also pullback and that should be an opportunity to buy the S&P 500 at lower levels, most notably the 3200 level.

It is worth noting that the NASDAQ 100 looks as if it is suffering a little bit, as we are getting a bit of rotation from various sectors in the stock markets. This does not mean that I would be a seller of the NASDAQ 100, but that I am more than likely going to focus more on the S&P 500 as although both of them are in an uptrend, it looks as if the S&P 500 will likely outperform. If it does, then I think it is only a matter of time before we break out to the 3400 level and possibly even further than that.

If we break down below the 3200 level, then we are likely to test the 3150 level, possibly even the 3100 level. The 50 day EMA underneath continues to offer a lot of support and therefore I think that buying on dips will be the best way going forward, as the Federal Reserve will continue to flood the markets with liquidity and therefore drive down the value of the US dollar. The thinking goes that if the value of the US dollar is lower, then the companies of the S&P 500 will be able to sell more of their goods and services overseas. That being said, buying on the dips continues to be the best way forward and I think that the trend of finding level is closer to the 3000 handle, where the 200 day EMA currently sits. All things being equal, the market continues to offer value every time it drops.