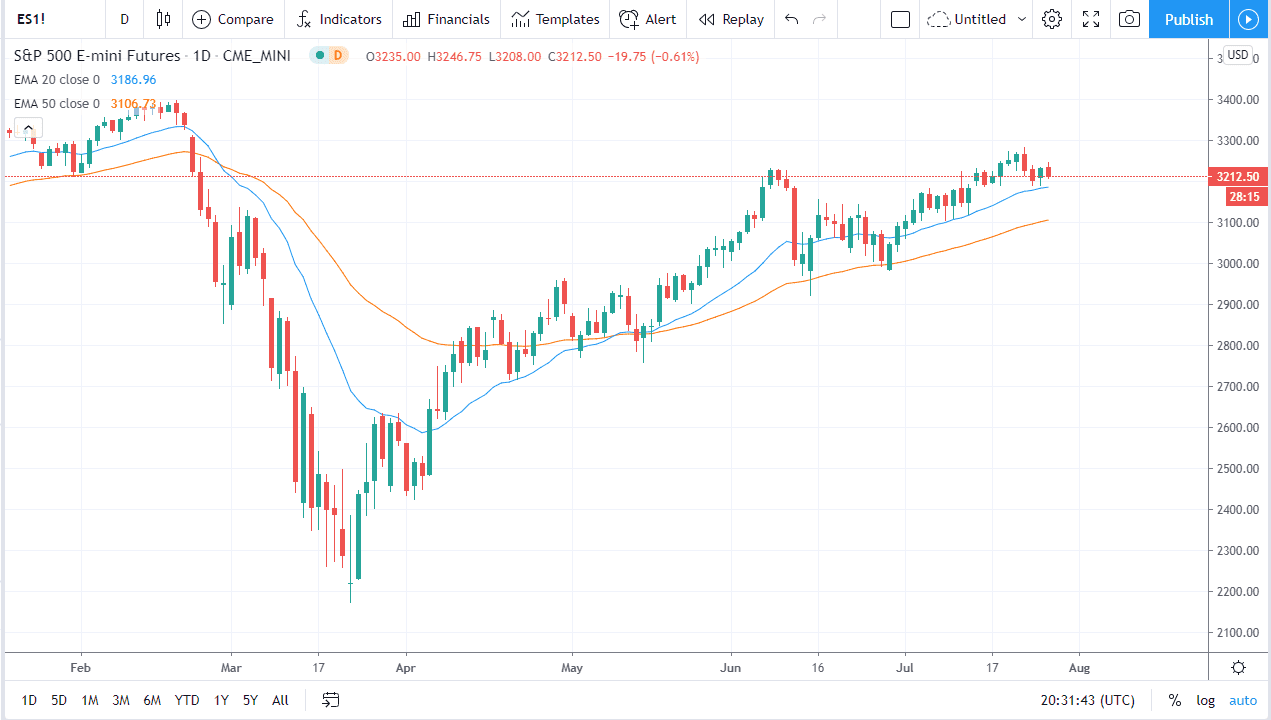

The S&P 500 initially rallied during the trading session on Tuesday but gave back the gains to reach towards the 3210 level. This is a market that has been in an uptrend for some time, but Tuesday was a bit of a mixed bag as earnings were a little less than impressive going into the session, but after the session, we are already starting to see some signs of hope. The 20 day EMA sits just below and that should offer plenty of support so I think that we will more than likely see buyers somewhere near that indicator or perhaps extending down to the 50 day EMA which is currently at the 3100 level.

The 3100 level of course is a large, round, psychologically significant figure, so that and the 50 day EMA being at the same place makes quite a bit of sense. Even if we were to break down below there, I think that the 3000 level is even more crucial. Overall, this is a market that continues to run on stimulus and continues to rally. I think that will be the story going forward, as long as the Federal Reserve and the U.S. Congress does what it does most of the time, meaning keep the markets liquid.

At this point in time, I have no interest in trying to short this market, because it has been so stringent. I think eventually we go looking towards the 3400 level but that might be a story for later this year, as there are obviously a lot of headlines out there that could cause chaos. Coronavirus, economic slowdown, and US/China trade relations all work against this market, but people really do not care as long as that cheap money continues.

If we break down below the 3000 level, that would be a significant breakdown and I would have to rethink some things, but overall, that seems to be a very unlikely scenario. Quite frankly, the FOMC statement during the day on Wednesday will probably be as accommodating as possible, because the Federal Reserve works for Wall Street, and comes to the rescue every time something bad goes on. At least that has been the case for the last 12 years or so, and unless they suddenly change their attitudes, I do not see that changing during the day. Buying dips has been working for months, and that probably continues to be the case.