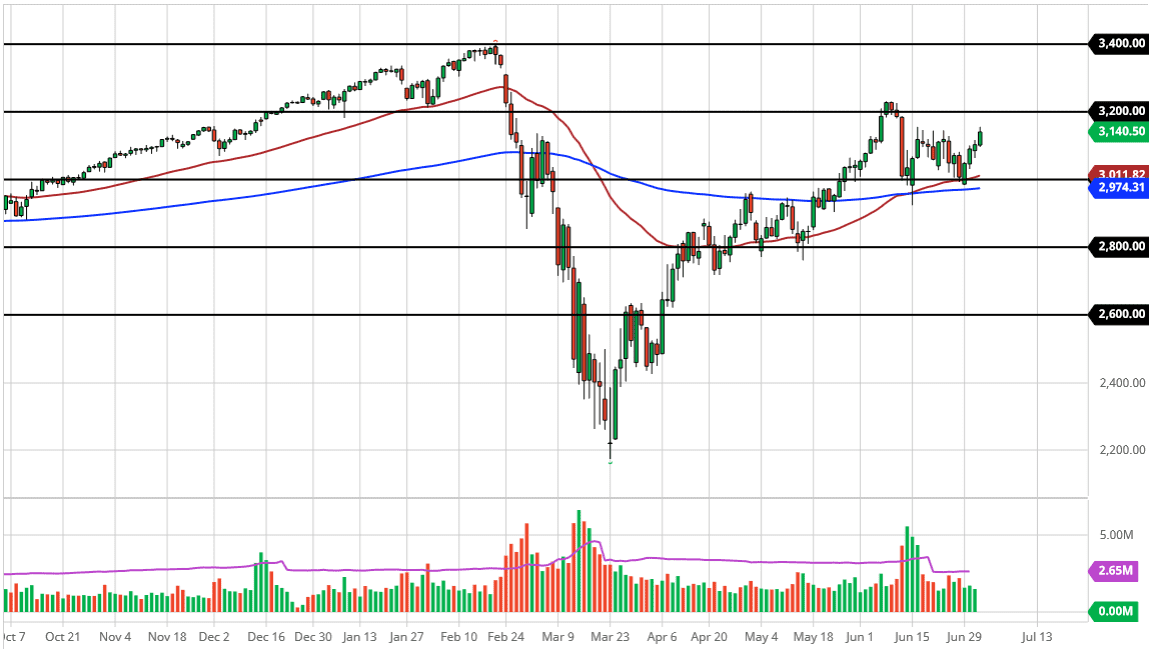

The S&P 500 rallied a bit during the trading session on Thursday after the jobs number came out much better than anticipated. That being the case, the market continues to see reasons to buy the market regardless. After all, the Federal Reserve has the backs of Wall Street traders, so therefore they are somewhat fearless traders now, meaning that they will buy the dips. We did not break above the 3150 level, at least not for anything significant, so we still have to deal with a significant amount of resistance in that region.

Looking at this chart, it looks as if we are at the top of a significant range that extends from the 3000 level to the 3150 level. The 50 day EMA sits just below, and it is highly likely that it will continue to be important in this market. I also look at this as a market that will probably offer the occasional pullback that traders will be taking advantage of. After all, this is a market that simply cannot fall for a significant amount of time from what we see.

Even if we were to break down below the 200 day EMA underneath, I think that as far as this market can go would be down to the 2800 level. That being said though, it is very unlikely to be tested anytime soon, because this market is dealing with so much in the way of liquidity that it is difficult to sell it. With the Federal Reserve forcing all of this money into the markets, it is difficult for this market to break down. If we can break above the 3200 level, which would be the next target based upon a breakout above the 3150 level, then we should go looking towards the highs again rather quickly.

The S&P 500 continues to be very choppy, but with the way that the indexes waited, it is a lot like the NASDAQ 100 in the sense that it is built to go higher. When you have companies like Apple at the top of the list, it is almost impossible for this index the fall for any significant amount of time. We recently had seen a bit of a crash but look how quickly we turned around and continued as if nothing happened. With this, it is a one-way bet although there are times when you should be on the sidelines or wait for lower pricing.