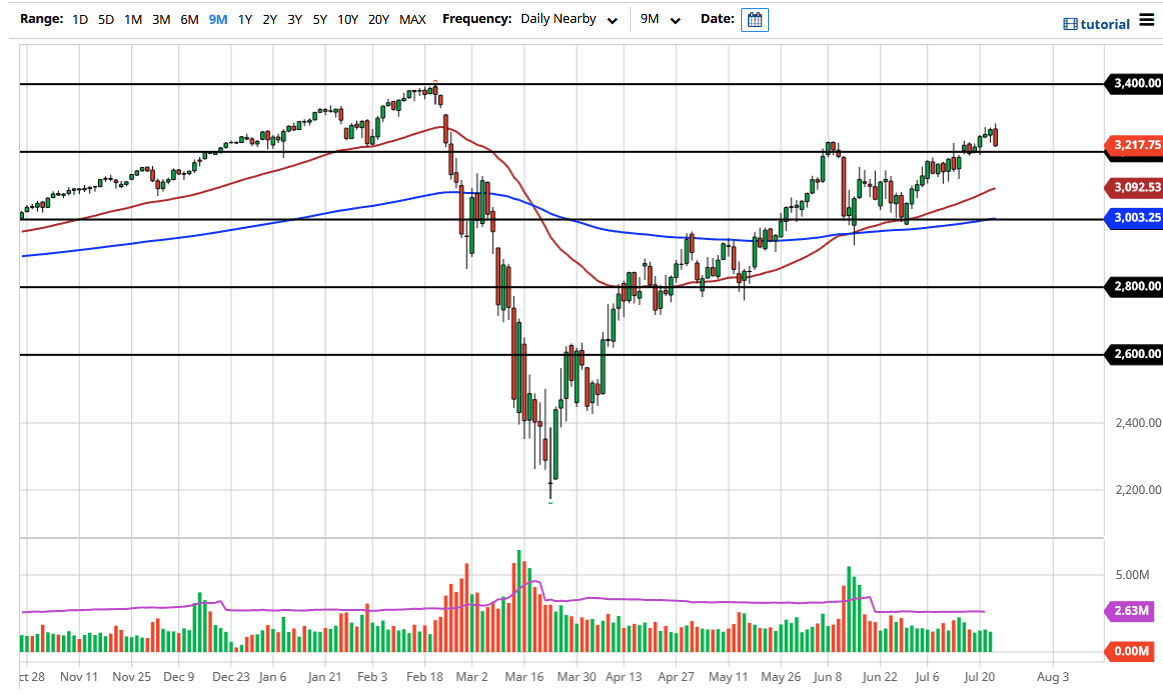

The S&P 500 got hit pretty hard during the trading session on Thursday, reaching down towards the 3200 level. Ultimately, this is an area that had previously been resistance so it should now be support. Yes, Apple got hit, hard as did a few other of the major names during the day, but at the end of the session, it does look like we are starting to see a little bit of a bounce back. After all, stocks only go up in the long run, and the Federal Reserve is out there willing to bail anybody out on a big move.

One has to wonder how long it will take for traders to start thinking along those lines if they are not already. I think that this is a market that is simply looking to take a little bit of profit heading into the weekend so do not be surprised if we drop a little further. I would be a buyer of that dip though but might wait until Monday in case there some type of major headline that crosses the wire over the weekend. If we do break down a bit further, I think there is plenty of support near the 3100 level and of course the 50 day EMA underneath.

The 3000 level is an area that I would also be paying close attention to, because it is a large, round, psychologically significant figure and one that has attracted a lot of attention in the past. I think at this point we are more than likely going to see a lot of people coming back into the fray and trying to pick up stocks “on the cheap”, assuming we even get anywhere near there. Yes, its earnings season but quite frankly that is but a blip on the radar anymore, because the stock market only cares about one thing: liquidity. As long as the Federal Reserve is out there pumping the markets full of liquidity, it will go up given the eventualities of that scenario. I think at this point in time buy the dips continues to work but again I think we may have to wait until Monday to do so. This is a time to start panicking, it is just a garden-variety pullback so far, and I do not expect it to get a whole lot worse, although Friday could be just a bit negative.