The S&P 500 pulled back a bit during the trading session on Thursday, as we had hit the highs again only to falter. Global markets were generally soft so this should not be a huge surprise. I think that given enough time we will probably continue to see a bit of a struggle in this general vicinity, but it is also only a matter of time before we break out in my estimation. After all, the Federal Reserve is behind the back of Wall Street so therefore it can only fail for so long.

Granted, we are in the midst of earnings season so that of course has a certain amount of importance attached to it, but at the end of the day nobody cares about the fundamentals, they care about the liquidity coming out of the Federal Reserve. Look at these shakeouts like we had during the trading session on Thursday as a potential value play, because it is only a matter of time before Wall Street comes back to work. There was a certain amount of fear but at this point in time it is more than likely short-lived at best. In fact, it would not surprise me at all to see this market turn around on Friday and reach towards the highs yet again. In fact, I am kind of expecting it to happen. That being said, there is also a little bit of a gap underneath that was not quite touched, so we could go down as low as 3180.

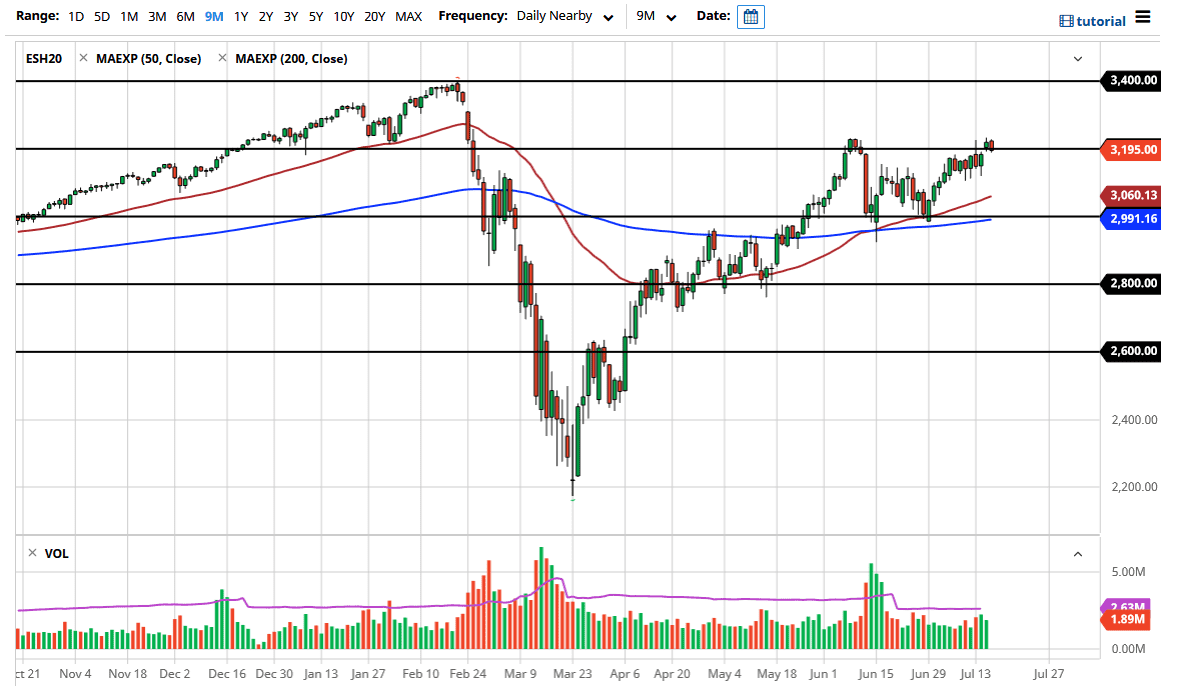

If we break down below there, then the 3150 handle is the next argument, where buyers will probably come back in. Under that, then we have the 50 day EMA. Finally, we now have the 200 day EMA at the 3000 level, so in that general vicinity I would anticipate a certain amount of support based upon the technical indicator and of course the large, round, psychologically significant figure. All things being equal, as Davey Day Trader says, “stocks only go up.” It is really lazy thinking that the reality is that the liquidity continues to push the market higher over the longer term, and as long as fundamentals do not matter, we are going higher. We may get the occasional crash, but that will be fixed by Jerome Powell and company.