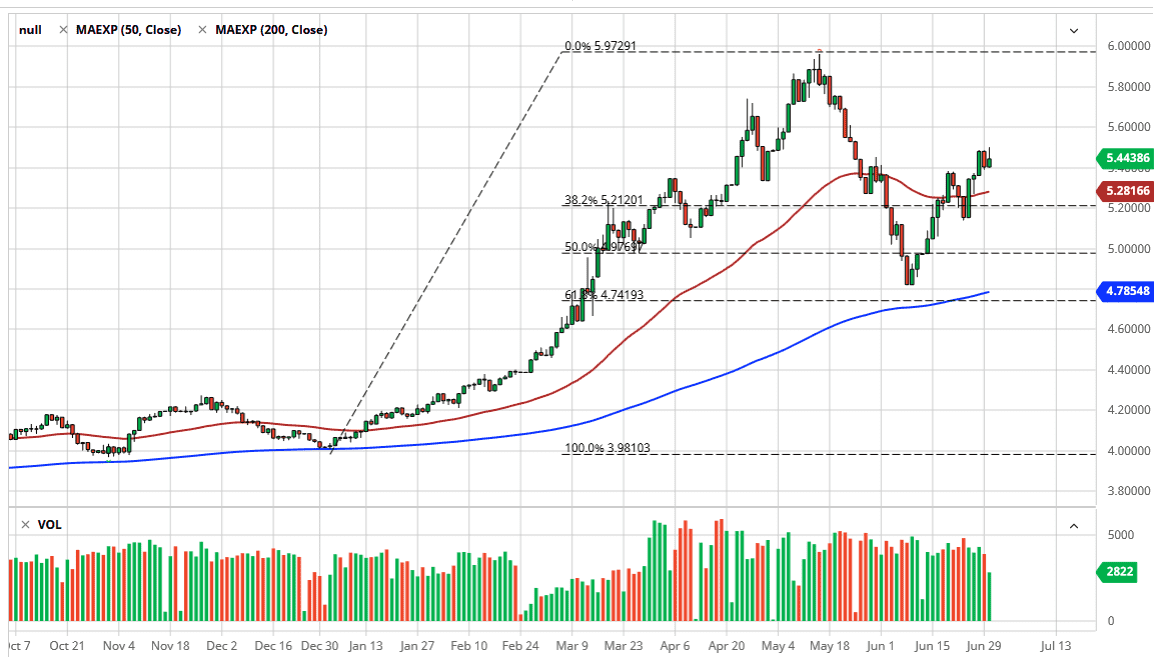

The US dollar has rallied initially against the Brazilian Real during the trading session on Tuesday, as we continue to test the 5.50 Real level. The last three days have seen the market try to break above there, but simply could not. At this point, the market is likely to accelerate to the upside if we can break out above the 5.50 level. In that movie, I would anticipate the US dollar to reach towards the 5.60 level, and then possibly the 5.80 level after that. The 6.00 level would be the target ultimately, which was the most recent high. Furthermore, it is also a large, round, psychologically significant figure so it would make a certain amount of sense that we would have a lot of supply in that general vicinity.

Looking at this chart, you can read into it a certain amount of perception when it comes to the coronavirus numbers coming out of Brazil. Latin America is currently struggling with an explosion in infections, and the Brazilian numbers are particularly bad. In fact, it has gotten so bad that the government does not even report the numbers half the time now, so a lot of the numbers are essentially a guess. Coronavirus seems to be running rampant in Brazil so that is going to continue to be a major issue.

Another thing that this pair can measure is the risk appetite globally. Because of this, you can look at the market rising as a sign that people are moving away from emerging markets, and into the US dollar itself. The US dollar suggests safety, just as the US Treasury market will. The bond market demands US dollars, so that of course is something that influences this market. The 50 day EMA is sitting just below and we had previously found the 200 day EMA supportive previously. The 200 day EMA sits right around the 61.8% Fibonacci retracement level, so that of course is an area that a lot of people would pay attention to. At this point, I think we are going to get a short-term pullback that should give us a buying opportunity near the 50 day EMA or perhaps the 5.20 Real level. If we break out to the upside of the highs from the last three sessions, then we will simply go higher right away as it would be a significant sign of strength.