India’s economy is under significant stress related to the global Covid-19 pandemic. It prompted the International Monetary Fund (IMF) to revise its outlook to reflect a 4.5% GDP contraction for the current financial year ending March 2021. By comparison, a few weeks ago, the IMF forecast a 2.0% expansion. The sharp reversal confirms the severe negative fallout of the intensifying global crisis. Despite the downward adjustment, repeated across most economies, the USD/INR maintains a bearish bias driven by US Dollar weakness. After the breakdown below its short-term resistance zone, selling pressure is expanding.

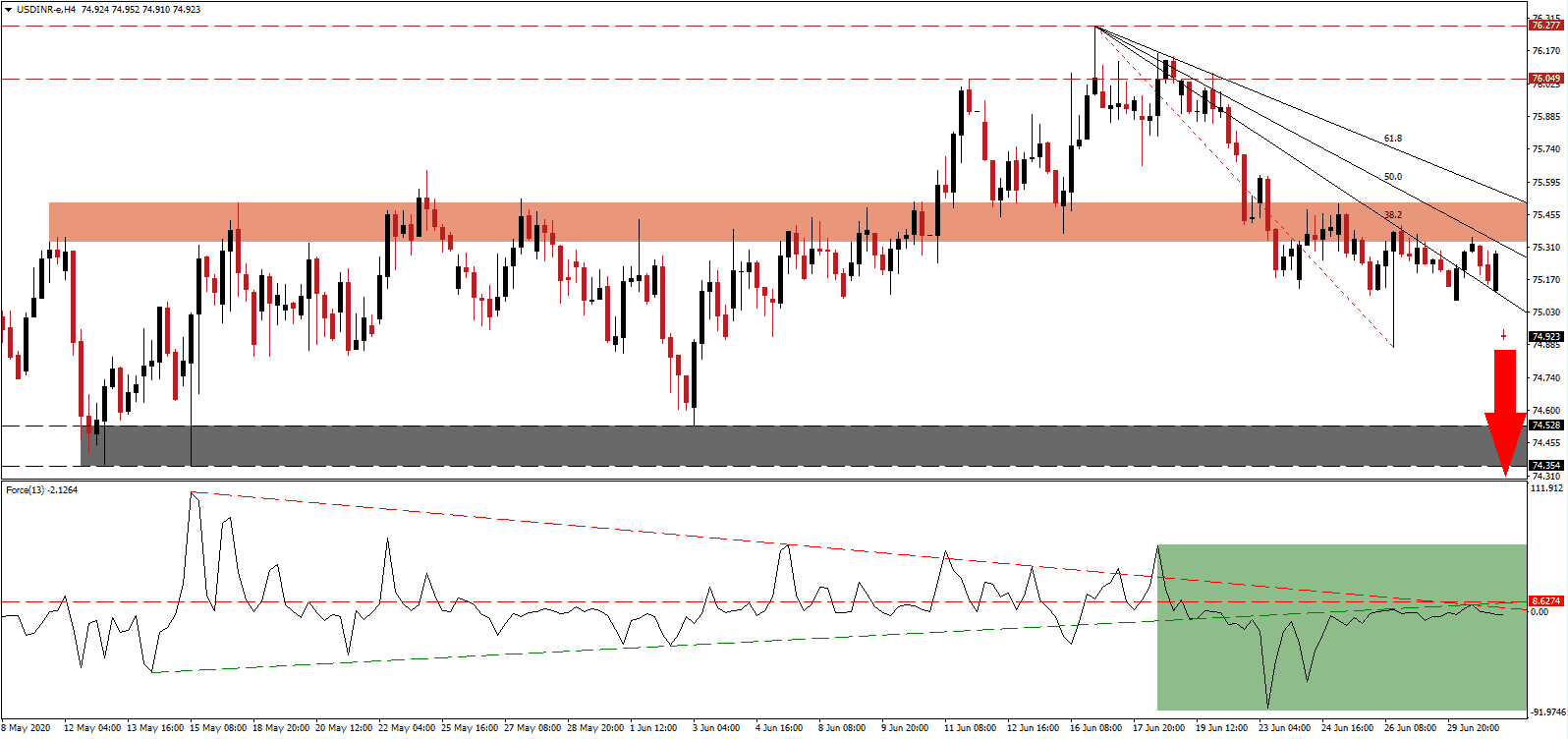

The Force Index, a next-generation technical indicator, confirms the dominance of bearish momentum after reversing from a multi-month low until being rejected by its horizontal resistance level. Following a brief challenge of its ascending support level, as marked by the green rectangle, downside pressures are magnified by its descending resistance level. With this technical indicator below the 0 center-line, bears are in full control of the USD/INR.

Prime Minister Modi is potentially faced with a humanitarian crisis across India. Estimates confirm that the loss of three months’ worth of income will place 50% of the population into poverty, reversing all positive progress since the liberalization of the Indian economy in 1991. With India on course to become the third most infected country with Covid-19, a strain on public finances challenges welfare programs, which may become a necessity moving forward. Fiscal responsibility practiced by the Modi government keeps the corrective phase intact. The USD/INR, followed the rejection by its short-term resistance zone located between 75.333 and 75.504, as marked by the red rectangle, with a price gap to the downside.

Yesterday’s data showed India managed a current account surplus of $0.58 billion or 0.10% of GDP in the first quarter. The government is also boosting its foreign currency reserves to all-time highs, exceeding $500 billion. Adding to breakdown pressures in the USD/INR is dismal economic data. The Chicago PMI for June clocked in well below forecasts, icing hopes for a V-shaped recovery. The descending 38.2 Fibonacci Retracement Fan Resistance Level is expected to drive price action into its support zone located between 74.354 and 74.528, as identified by the grey rectangle. A breakdown extension into its next support zone between 72.695 and 73.303 is favored to materialize.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 74.950

Take Profit @ 72.700

Stop Loss @ 75.600

Downside Potential: 22,500 pips

Upside Risk: 6,500 pips

Risk/Reward Ratio: 3.46

A breakout in the Force Index above its ascending support level, serving as resistance, can inspire the USD/INR to push higher. With more US data suggesting a painfully slow recovery ahead, and job growth limited to low-skill, low-income jobs, any advance from current levels will grant Forex traders a secondary short-selling opportunity. The upside potential remains limited to its resistance zone between 76.049 and 76.277.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 75.750

Take Profit @ 76.050

Stop Loss @ 75.600

Upside Potential: 3,000 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 2.00