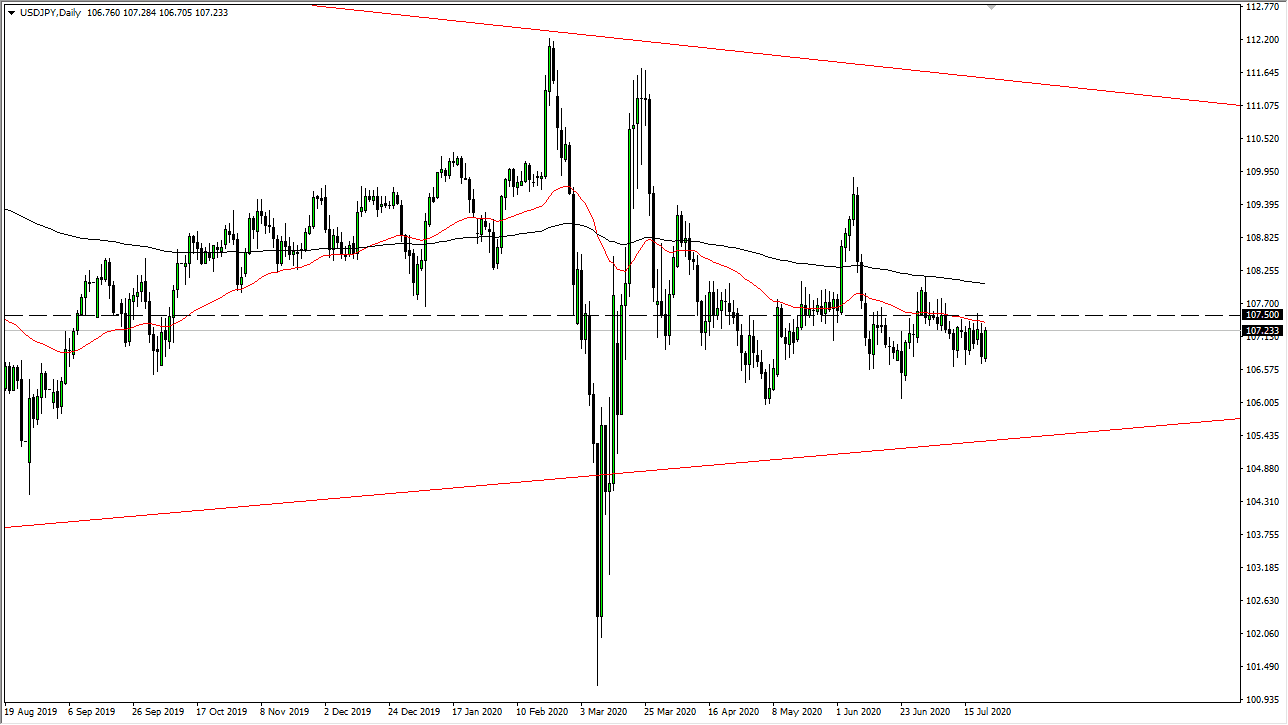

The US dollar has rallied significantly during the trading session on Wednesday, reaching towards the ¥107.50 level. This is an area that should continue to offer resistance though, as we have simply bounced back and forth between that level and the ¥106.80 level underneath. Overall, it looks as if we will continue to trade back and forth and try to figure out where we go long term.

The market breaking above the ¥107.50 level would be a challenge to the resistance that extends all the way to the 200 day EMA, which is sitting at roughly ¥108 level. As we have rallied during the day on Wednesday, I will be looking for signs of exhaustion in that general area to start selling. Either way, I have absolutely no interest in trying to buy this pair, because the US dollar finds itself on the back foot when it comes to almost everything.

This pair has been particularly tricky, as it has been more or less a short-term trading environment, as we try to figure out where to go next. The 50 day EMA is sloping slightly lower, so that should continue to pressure this market to the downside overall and as we see the US dollar being punished against most currencies, that also plays a part in this pair. However, the Japanese yen is also considered to be a “safety currency”, so stock markets have their say as well. We have been doing nothing in this pair for some time, so I believe that we will eventually have to make a bigger move. If we can break down below the ¥106 level, then it is likely we will break down towards the ¥105 level, followed by the ¥102 level. I really do not have a scenario in which I’m willing to buy this pair until we can break above the 200 day EMA, which means the ¥108 level. At that point, we could very well see this market go looking towards the ¥110 level, but I do not see this as being overly likely. With this, I prefer shorting the market in this tight range, hoping for some type of break down below that ¥106 level eventually. That being said, it is clear that we have a nice well-defined range in this market so you might as well take advantage of it.