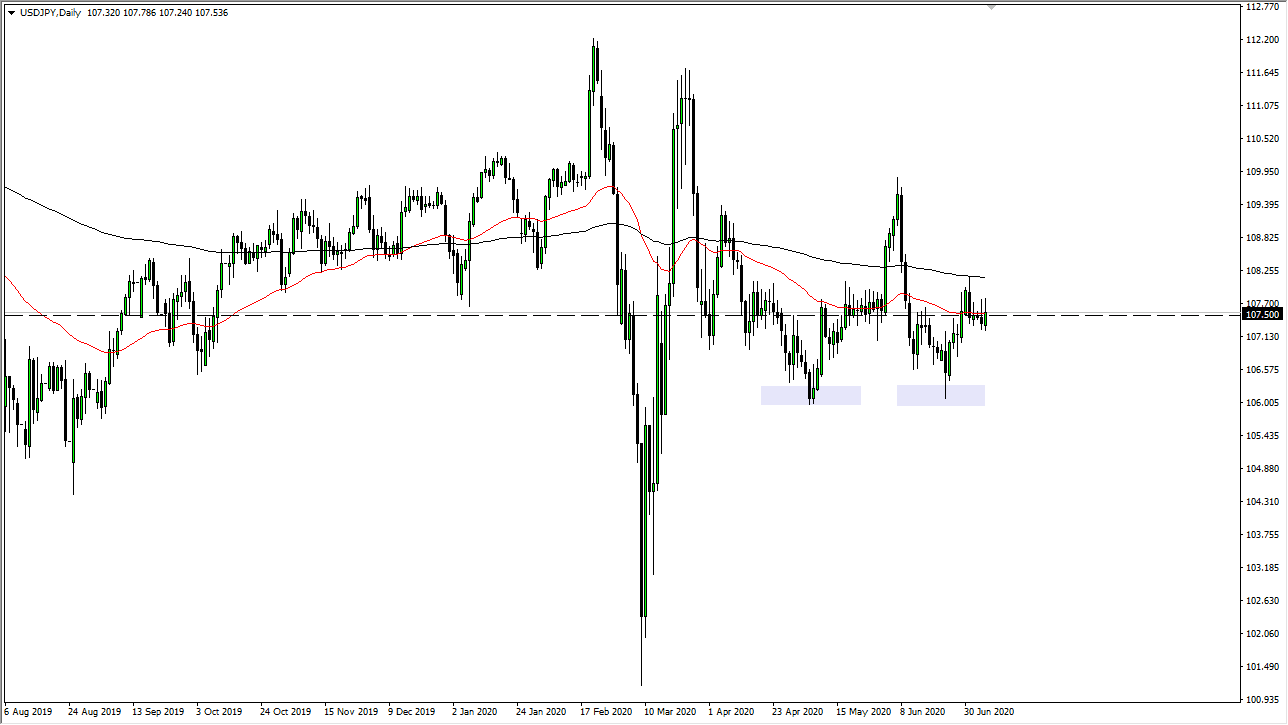

The US dollar has rallied a bit during the trading session on Tuesday, breaking above the ¥107.50 level. The market is likely to go looking towards the ¥108 level again, which is an area that could have a bit of importance attached to it, but if we can break above there it is likely that the market will go looking towards the 200 day moving average. That is a market indicator that a lot of people will pay attention to, so it is likely that we will see sellers in that general vicinity.

If we were to reach towards that area, I think that a lot of sellers will come back into play. However, if the market breaks above the 200 day EMA on a daily close, then it is likely we go looking towards the ¥110 level. That is an area that has seen a significant amount of resistance, so I think at that point you would see a lot of selling pressure. If we were to break above there, then you could be looking at a much bigger move. However, I do not see that happening right now, as this continues to chop back and forth, almost as a proxy for the overall Forex markets as they do not seem to be ready to do much.

Looking at this chart, if we break down below the lows of both the Monday and Tuesday session, we could send this market down to the ¥106 level. That is an area that has been supportive lately and we have found quite a bit of pressure to the upside there, forming a bit of a “double bottom.” Looking at this chart, the 50 day EMA is slicing through the candlestick, but with a slight negative tilt. This tells me that we are more than likely going to drop than rally once we finally do make a move, so I think that it is only a matter of time before you can be selling this market again. I think at this point the market continues to be one that is going to basically choppy and sideways. If you are a short-term trader, you can take advantage of this but I think you need to keep your trading position somewhat smaller than usual, considering that it continues to be very noisy and difficult to handle.