The US dollar has rallied a bit during the trading session on Monday to kick off the week, but at this point, I think the likelihood of anything major happening is probably minuscule. At this point, it is more than likely going to be a scenario where we see a lot of back and forth trading on short-term charts, and therefore it is likely that we will see more scalping than anything else. This market simply cannot seem to get its act together, and I think that is going to continue to be the major problem. That being said, it is only a matter of time before we get some type of bigger move, and that could send the market to a large trend either up or down.

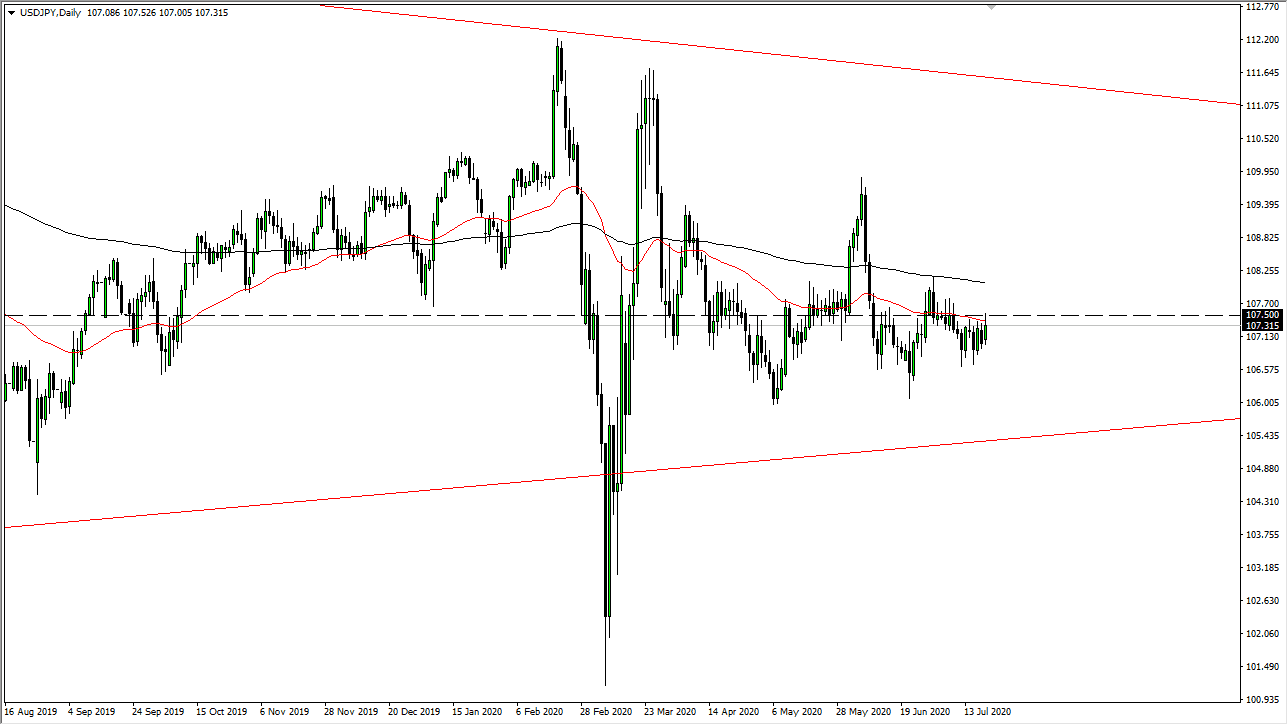

The ¥107.50 level continues to be a ceiling in this market, as the 50 day EMA sits just below there. In fact, there is an entire “zone of resistance” that extends all the way from there to the 200 day EMA, which is closer to the ¥108 level. Honestly, I am bored of analyzing this market as it seems like it has nowhere to be. I do not think this market is going to be were trading other than to scalp off of the five-minute chart. If you have the ability or the desire to sit in front of your computer all day, then you probably have an opportunity to trade between the ¥106.75 level on the bottom and ¥107.50 on the top. Simply trading back and forth has worked out quite well overall, but eventually, we will break out of these doldrums, perhaps offering an opportunity to make real money.

If we break down below the ¥106 level, then I think we could go to the ¥105 level. That is the most likely scenario at this point, but if we were to turn around and break above the 200 day EMA, which is closer to the ¥108 level, then we could go looking towards the ¥110 level. In general, I believe that this is a market that continues to frustrate anybody trying to make significant returns, but if you are a short-term day trading scalper, then this might just end up being one of your favorite markets at the moment as we have such a well-defined area of interest.