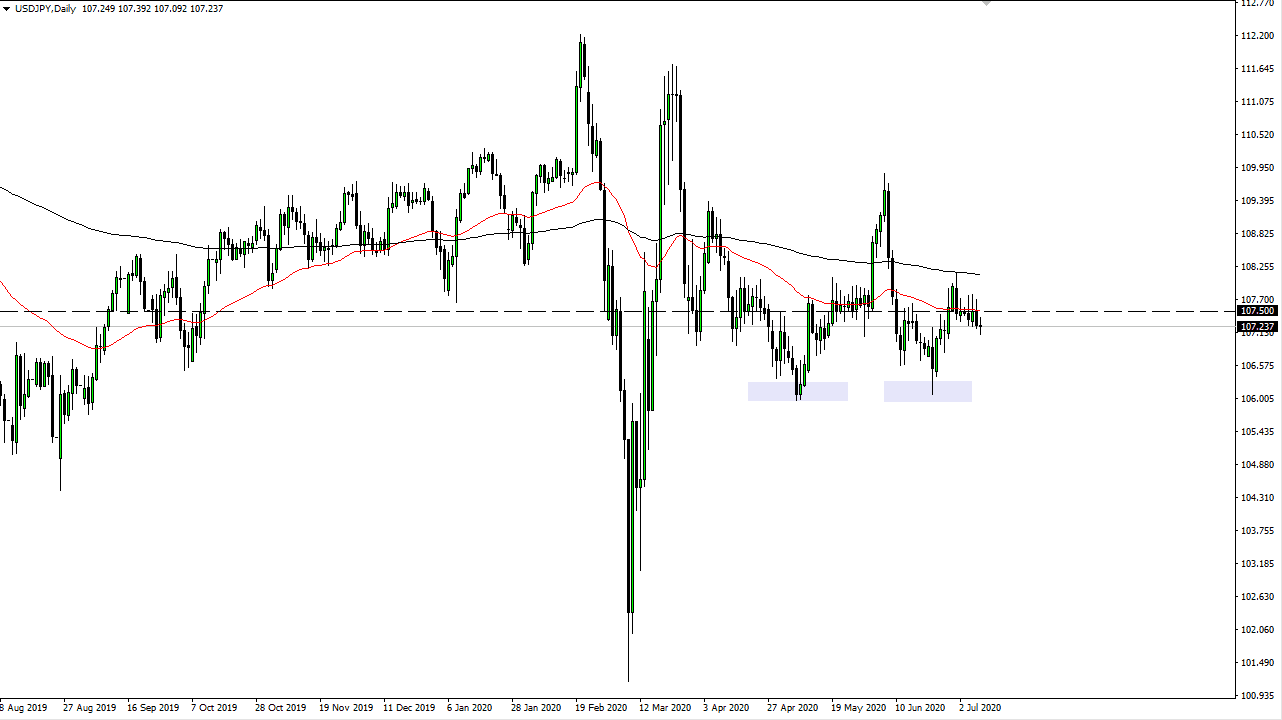

The US dollar went back and forth during the trading session on Thursday, as we continue to see a lot of noise in this pair. The 50 day EMA is an area that a lot of traders will be paying attention to, as it is such a strong longer-term indicator when we are trading. The 50 day EMA is also hanging about the ¥107.50 level, an area that has been important for the market and has shown itself to be a bit of a magnet for price. With this, I believe that the market participants will continue to look at this as an opportunity to fade the US dollar as it gets to be a bit too expensive.

To the downside I see a significant amount of support, especially near the ¥106 level, which I do believe is significant support due to the fact that we have formed a massive double bottom. If we were to break down below there then it is likely that the US dollar will drift down to the ¥105 level underneath, as it is a large, round, psychologically significant figure. The market breaking down below there could open up a move down to the ¥102 level, where we had seen a major bounce back previously.

I do believe that as we are simply grinding a bit lower over time, it is only a matter of time before we break down. I like the idea of fading short-term rallies, but I do not anticipate that we are suddenly going to break down drastically. I think this is more of a grind than anything else due to the fact that the dollar and the yen are both considered to be safety currencies. With that, expect a lot of choppy behavior but at the end of the day the Federal Reserve is flooding the world with US dollars and that of course is going to continue to cause a bit of a problem.

To the upside, the 200 day EMA which is currently sitting at the ¥108 level should offer a bit of resistance, but a break above there could open up the idea of a move towards the ¥110 level, although I do not see that happening anytime soon.