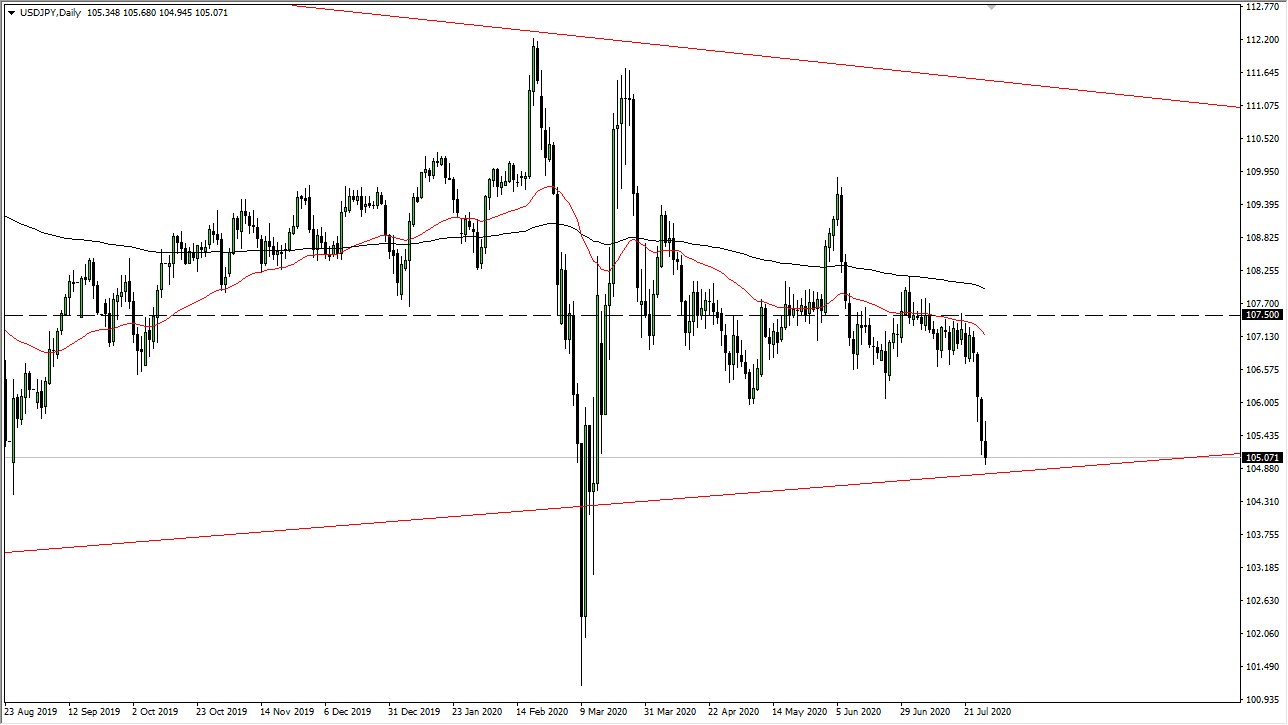

The US dollar initially tried to rally during the trading session on Tuesday but gave back the gains in order to roll over again. We have dropped towards the ¥105 level, an area that has a certain amount of psychological importance attached to it, just as it has structurally important issues attached to it. With that being said, I do think that we are on the verge of something rather interesting, and if we break down below the ¥105 level handle, that could be the beginning of a move down towards the ¥102 level. The shape of the candlestick is a bit of an inverted hammer, so it suggests that we are going to see a lot of negativity, but ultimately this is a market that eventually will find reasons to break down.

I stated yesterday that I still like the idea of fading short-term rallies, and I think that we will eventually get the opportunity to do so. Short-term charts might be the best way to trade this market, but I certainly would not be a buyer. We made an attempt at a decent rally but failed miserably. I think at this point, we will more than likely continue to see a lot of US dollar negativity.

That being said, it might be a little bit difficult in this scenario due to the fact that the Japanese yen is also a safety currency, so it is kind of counterintuitive for the Japanese yen to strengthen here, but I think at this point the market is likely to worry more about the Federal Reserve and the falling US dollar than anything else. That is why think that we break down, even though stock markets may rally in the process. It is a bit of a disruption of the normal correlation, but it is all about the US dollar these days, and therefore I think that the only thing you need to pay attention to. Quite frankly, I do not have a scenario where I’m willing to buy this pair, at least not at the moment. Once we break down below the ¥105 level, it is likely we go looking towards that ¥102 level, and a break underneath there will get the attention of the Bank of Japan.