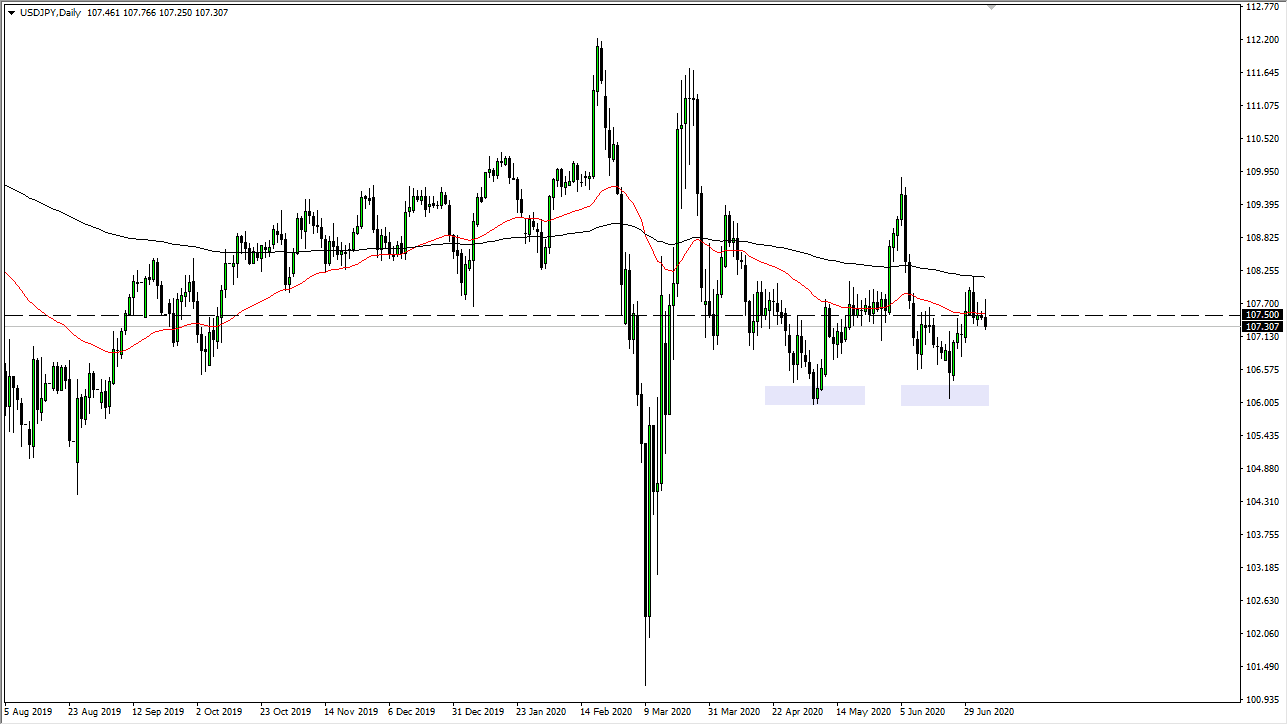

The US dollar initially tried to rally during the trading session on Monday, reaching towards the ¥108 level. However, we have turned around the market to reach down below the ¥107.50 level. Furthermore, we reached towards the ¥107.25 level, and formed a bit of a shooting star. At this point, I think that the market is probably going to try to continue 50 lower, and if it does this could either be the safety trade, meaning that traders are starting to buy the Japanese yen to protect themselves, or it could be a sign that the US dollar is losing strength, not only here but everywhere else.

To the downside, I believe that the ¥106 level should be important, as we have recently formed a bit of a double bottom down there, and it has shown it to be rather supportive. I do not think that we simply slice through it, and I think it will take some work to get low. If we do break down, the market is likely to go down to the ¥105 level, which of course is a large, round, psychologically significant figure and an area that has been important in the past.

After that, it opens up the possibility of a ¥100 print, something that almost always attracts the attention of the Bank of Japan so it would indeed be remarkably interesting down there. I do think that we are more likely to see this market break down than up, but I also recognize that there is the other possibility. If we break above the 200 day EMA, which is painted in black on the chart, it is likely that we then go looking towards the ¥110 level. That is an area that has been a bit of a magnet for the price previously. I do not know that we break above the ¥110 level, but if we do it is likely that we will pick up a couple of handles after that.

Keep in mind that the market continues to be very choppy in general, so I am not looking for big moves. I think back and forth with a bit of a fulcrum around the ¥107.50 level is the most likely of outcome. With this, I believe that the market remains very choppy and difficult to handle, so at this point keep your position size small and your timeframe somewhat short.