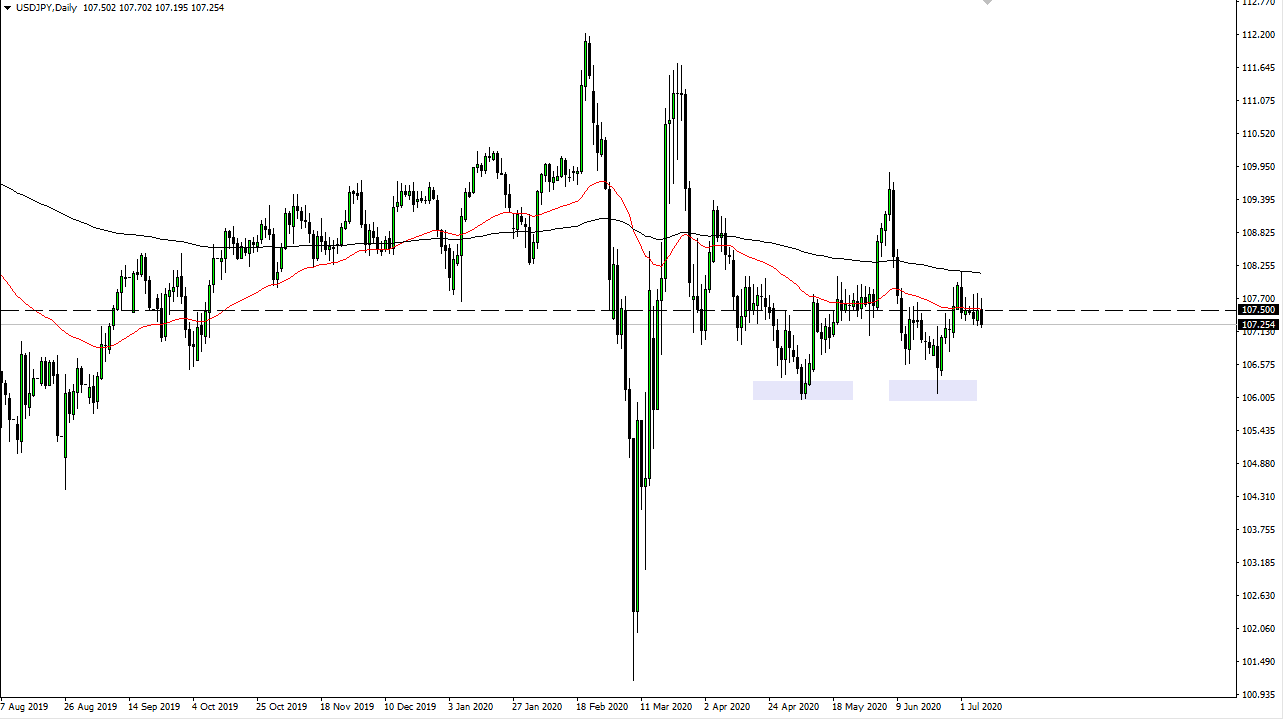

The US dollar initially rallied during the trading session on Wednesday but as you can see, we have seen a lot of exhaustion above the crucial ¥107.50 level. That is also where we see the 50 day EMA, and of course the 200 day EMA above that. There is a significant amount of noise in that general vicinity, so I think we will continue to see this market fade. The question now is whether or not this is going to be a market that is moving due to the fact that the US dollar is losing strength or is it something to the effect of “a risk-off move” overall. Ultimately, this is a market that I think is probably going to continue to see a move down to the ¥106 level, an area where we have seen a bit of a double bottom form. If that is going to continue to be the case, I think we are simply making a move in that general direction. However, if we can break down below there it is likely that we will go down to the ¥105 level after that, followed by the ¥102 level.

With this being the case, I think we could start to see a little bit of a move, but it would take some time. Expect a lot of volatility to come back into this market, and I think that fading rallies is now going to continue to be the major moving this market. The fact that we have broken down below the lows of both Monday and Tuesday suggests that we are going to continue to see a little bit of drift lower.

If we did turn around and break above the highs from the last three sessions, then we could see the market go looking towards the 200 day EMA, and a break above that opens up the door to the ¥110 level, something that I do not expect to see anytime soon, but I would not think of as being impossible the way that this market has been so choppy as of late. With all of this, the fact that we are closing towards the bottom of the range does suggest that we are going lower, despite the fact that it is not entirely clear whether or not this is a US dollar move or a “risk off move.”