The US dollar fell rather hard during the trading session on Wednesday as the greenback continues to take it on the chin. However, we did find buyers at the very bottom of the session against the Japanese yen, something that we have seen time and time again. This does make a certain amount of sense though, as both of these currencies are considered to be “safety currency.” Because of this, they tend to move on a lot of the same fundamentals so therefore it should not be overly surprising that if there is a bit of a scare in the market, both of these currencies get bought, and that tends to make this pair a bit sluggish. To say that there are a lot of concerns out there right now would be a massive understatement.

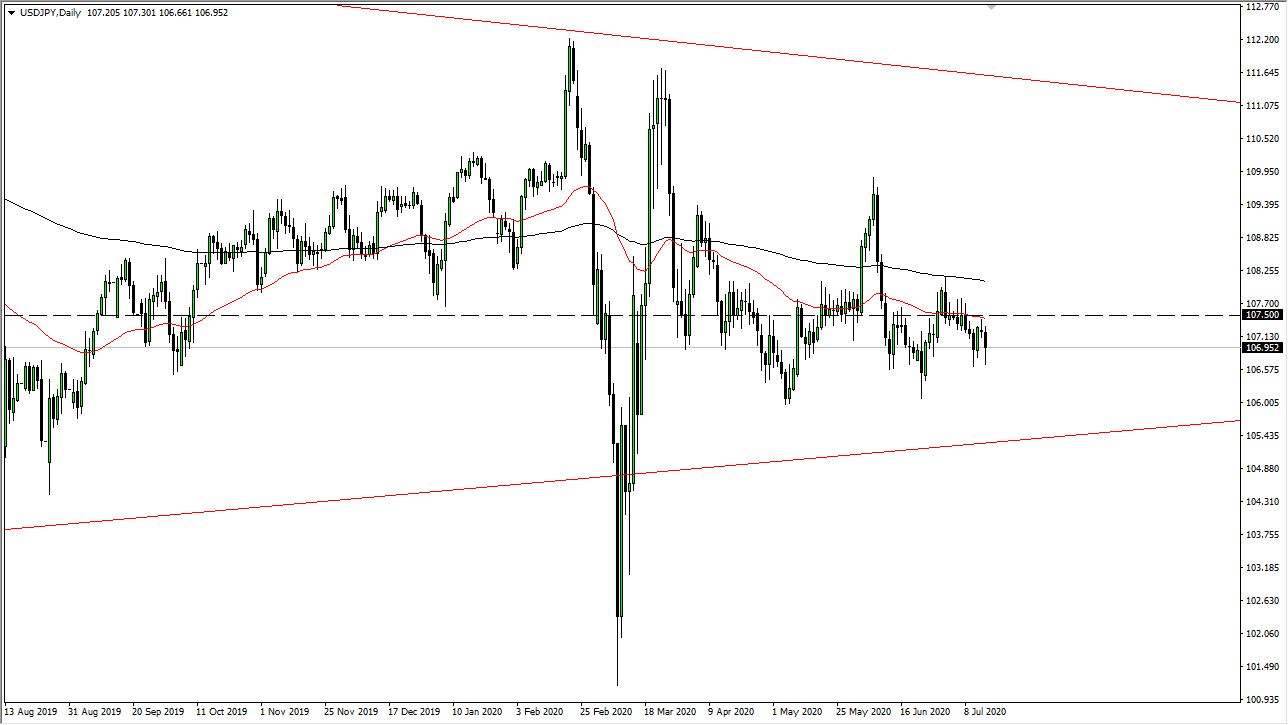

It is worth noting that the ¥106 level has not been violated yet, the scene of a recent double bottom. That double bottom will continue to attract a lot of attention so I think it is only a matter of time before buyers would look at that as a place to find a bit of value. However, if we did break down below the 160 and level it is likely that this pair will go down to the ¥105 level next. I do not have a scenario in which I am willing to get overly aggressive one way or another with this pair, as the ¥107.50 level has been a bit of a magnet for price. If we were to break above there then we enter that area between the 50 day EMA and the 200 day EMA, almost always an area of contention. Ultimately, I believe that this is a market that will eventually find its way for the longer move, but right now we are not seeing it. If anything, I would have to say that there seems to be a lot more pressure to the downside than up.

This is the type of market that is more or less built for short-term traders, as we continue to see various levels offer plenty of noise. If we do finally get an impulsive candlestick in one direction or another, it would be great because then we could finally have some type of trade. Until then, unless you are trading short-term charts this is essentially going to be dead money.