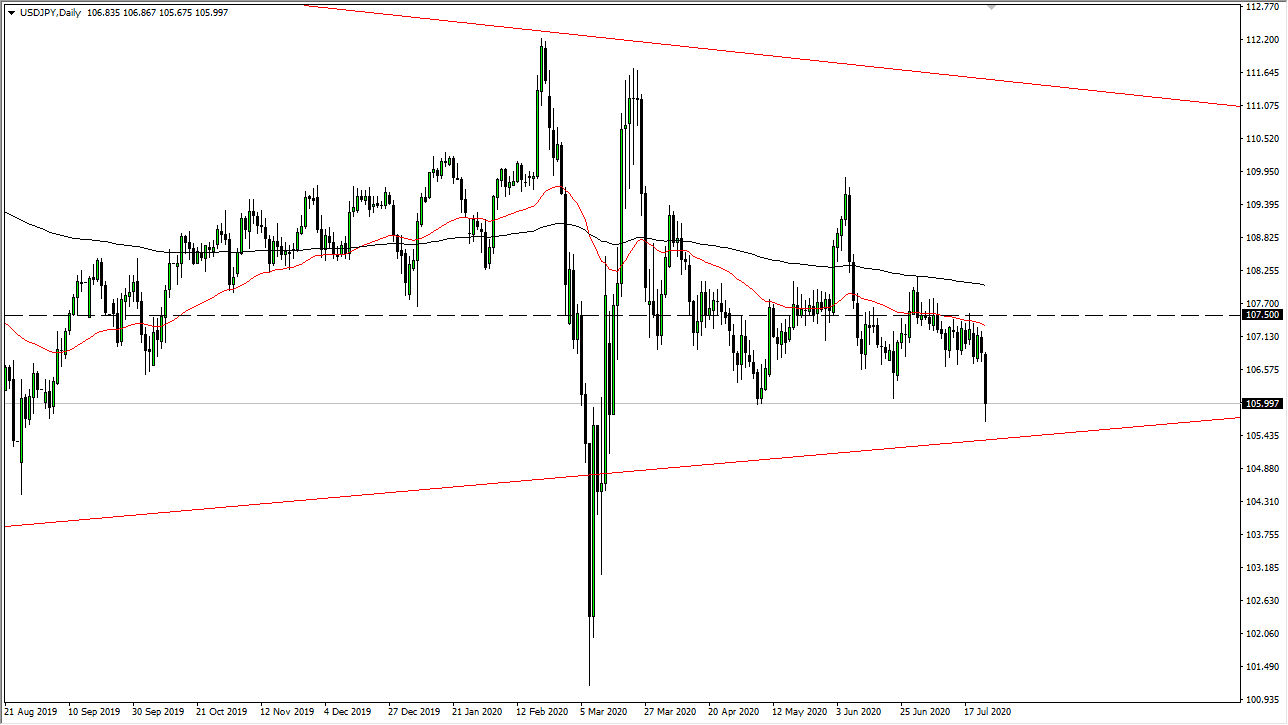

The US dollar fell off of a cliff during the trading session on Friday, reaching down below the ¥106 level during the day. However, we have seen a lot of interest in this general vicinity so I think it would not be a huge surprise to see this market turn around and bounce a bit. That in mind, I am still looking for selling opportunities at higher levels, because the pair has tested this area three different times, and now has made an even deeper dive into this level, so therefore I think that short-term rallies are to be faded, and it is difficult to imagine a scenario where we will suddenly take off to the upside.

Once we are significantly clear of the ¥106 level, the next target will be the ¥105 level. Underneath there, you are probably looking for a move towards the ¥102 level. I have no interest in trying to buy this market, at least not yet as the 50 day EMA sits just above the recent trading action, and just below the crucial ¥107.50 level, an area that has been extraordinarily important to the market over the last several months. After that, we have the 200 day EMA so I think there is a bit of a “zone of resistance” above. I think at this point it is obvious that the sellers are starting to flex their muscles, and certainly look as if they are going to take control.

It is worth noting that the US dollar is getting hammered against almost everything, so the Japanese yen is benefiting from that alone. When you look at the Japanese yen against other currencies, it is not necessarily rallying. It is all about the dollar getting crushed, and I think that will continue to be the main theme in FX markets. If that is going to be the case, then it is very likely that we not only get down to the ¥105 level but break down below there as well. The length of the candlestick for the Friday session is very telling as well, as typically when you get a longer candlestick like this you have a bit of follow-through given enough time. In general, I think we have some choppy yet negative trading ahead of us when it comes to this pair.