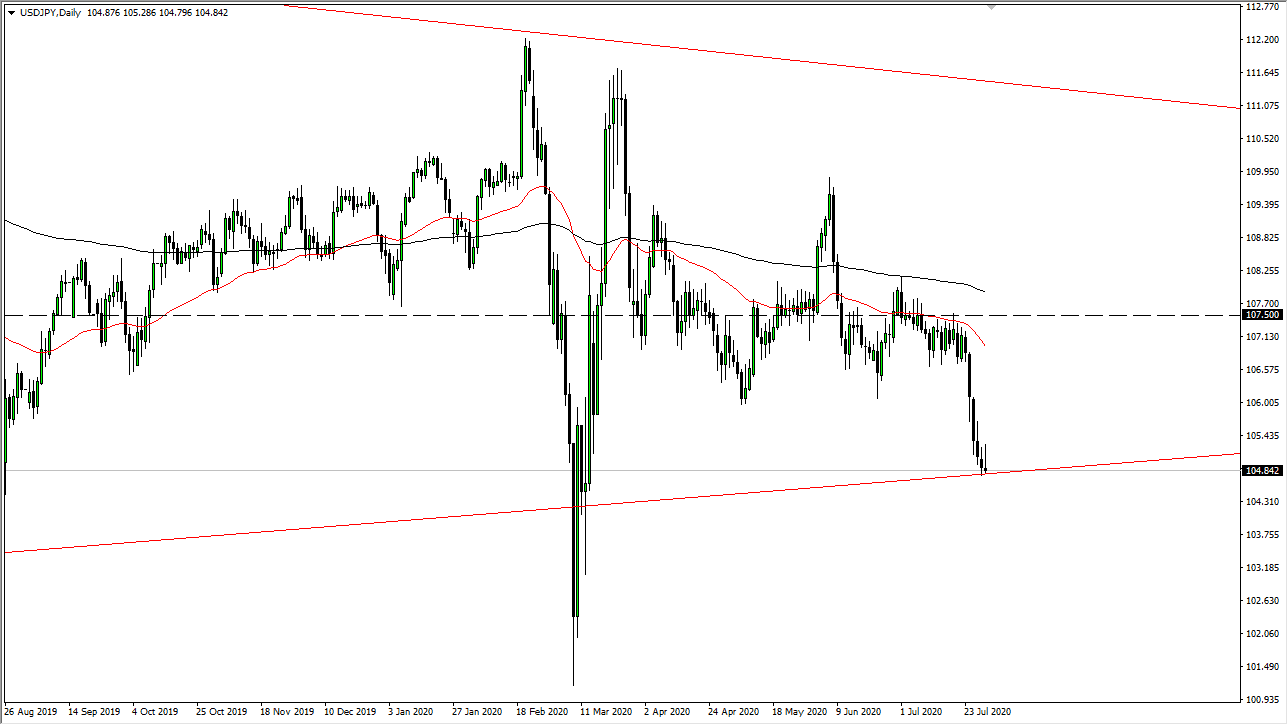

The US dollar initially tried to rally during the trading session on Thursday but gave back the gains as we continue to see a lot of trouble when it comes to the US dollar in general. A breakdown below the bottom of the candlestick for the Thursday session signifies that we are going to go much lower, perhaps down to the ¥102 level. After that, it is likely that we go looking towards the ¥100 level. In general, once we get to that level it is likely that the Bank of Japan gets involved and could start to jawbone the pair back up.

The shape of the candlestick could be thought of as a and “inverted hammer”, which can be very negative sign but if we turned around a break above the top of the candlestick it would be an extraordinarily bullish sign. That bullish sign will probably send this market to the upside, perhaps looking for trouble above, so I would be more than willing to short this market on signs of exhaustion. The 50 day EMA could be a significant barrier as well, but I think it is very unlikely that the market even breaks above the ¥107 level. The area between the 50 day EMA and the 200 day EMA should continue to offer a lot of resistance as well, so I think we are almost certainly in a move to the downside just waiting to happen.

At this point the Federal Reserve continues to loosen monetary policy and I think that will continue to be reflected in this currency pair. As we head into the weekend, it will be interesting to see how this plays out but longer-term I think the die has already been cast for this move. At this point, the market is likely to see a lot of volatility, but we are decidedly negative at the moment and therefore I do not have any interest in trying to buy this market as it certainly has a massive amount of trouble ahead of itself. If we were to somehow break above the ¥107.50 level in the relative near future, that could be a major change of trend, but I do not see that happening in this environment as we continue to pay attention to the Federal Reserve more than anything else.