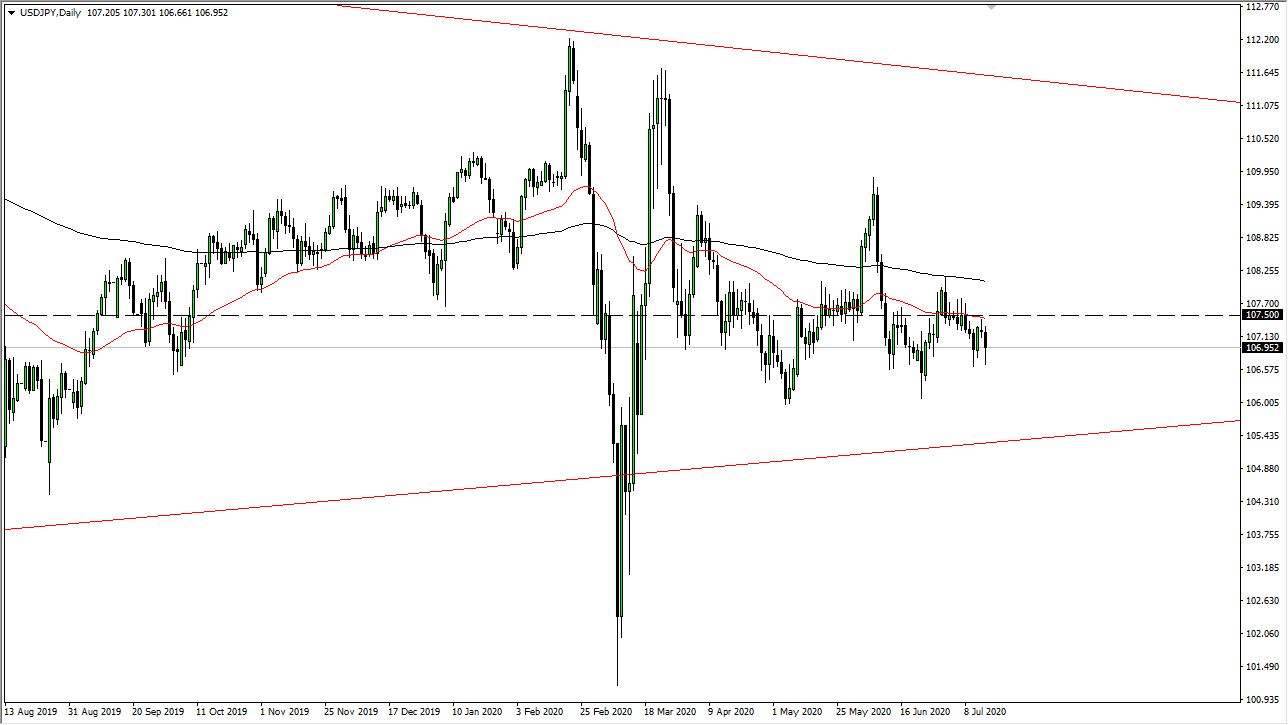

USD/JPY: Little going on here between 106.00 and 108.00

Yesterday’s signals were not triggered, as none of the key levels were reached over the past 24 hours.

Today’s USD/JPY Signals

Risk 0.75%.

Trades may only be taken between 8 am New York time Thursday and 5 pm Tokyo time Friday.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 107.10, 107.42, or 107.76.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 106.43 or 106.15.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Analysis

I wrote yesterday that we were seeing more specific weaknesses in the U.S. Dollar which was pushing the price down.

I thought the best bet for traders would be betting against a deeper fall, by trading long any reversals at the long-term pivotal support at 106.15.

This was an OK call as the price failed to get much below 106.70 where a bullish double bottom seems to have been formed, which is now pushing the price up. Volatility is low.

There is not much point in trading this pair except fading the extremes of the dominant range between about 106.00 and 108.00 or waiting for a breakout beyond these levels.

Concerning the USD, there will be a release of Retail Sales data at 1:30pm London time. There is nothing of high importance scheduled today concerning the JPY.