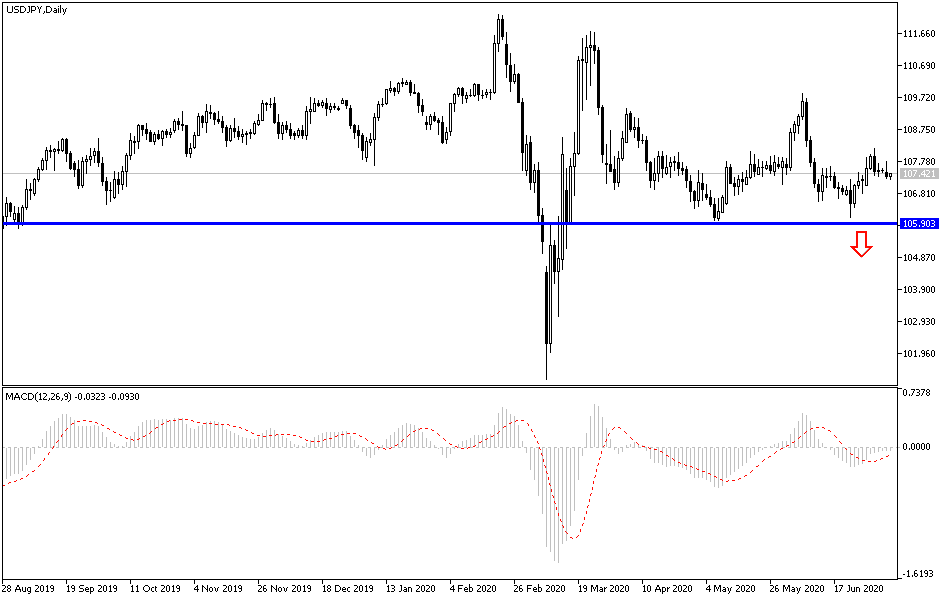

For several trading sessions in a row, the USD/JPY has been moving in a limited range amid a downward trend but remains stable below the 108.00 support. In early trading today, it fell to the 107.25 support before settling around 107.50 at the time of writing, in light of the quite trading week after a long American holiday. The pair did not react strongly with better than expected results for the US economic data, which in return is facing fears of increasing coronavirus cases, threatening the reopening of the largest economy in the world. As some US states began to impose some restrictions, including some who decided to contain the situation so that things would not go worst.

According to the US ISM Services Purchasing Managers Index, the sharp recovery in the US economy from its recession under the Covid-19 closure policy continued with the country's services sector returning to life in June. The index reached a reading of 57.1 and is very ahead of the expected 50.1 reading, and a significant improvement from the 45.4 reading recorded in May. As is well known, reading above 50 indicates growth in the sector, and therefore indicates that the services sector in the American economy is growing again, which helped the positive sentiment among investors at the beginning of this week.

In the wake of the numbers, equity markets rose and investors risk appetite increased.

According to the details of the results, the activity/production index - the sub-component of the report - rose up to its highest level in 15 years at a reading of 66.0. However, the ISM's message is that employment continues to recover with the employment component reading at 43.1, which is important given that the services sector accounts for nearly 80% of the workforce in the United States of America. Further details appear in the report that supplier shipments decreased by about 10 points and orders increased significantly to 61.6, until accumulated orders moved to the growth area.

After the announcement of the results, the Dow Jones Industrial Average witnessed a rise of 1.65% at 26209, the Standard & Poor's 500 Index rose 1.60% to 3179 while the EUR/USD exchange rate was pushed up by half a percent to 1.1340 and the pound exchange rate rose to 1.2510 USD.

According to the technical analysis of the pair: There is no change in my technical view of the USD/JPY pair, as the bearish move will remain stronger as long as it remains stable below the 108.00 support and there will not be a real and strong reverse of the bearish outlook without the pair breaking the 110.00 psychological resistance, which requires strong confidence from investors in the containment of a second coronavirus wave to avoid the US economic shutdown. COVID-19 confirmed cases are increasing in 41 of the 50 US states in addition to the District of Columbia, and the percentage of tests with positive cases of the virus increased in 39 states.

Florida, which hit an all-time high of 11,400 new cases on Saturday and recently seen its positive test rate of over 18%, has been hit particularly hard, along with other states from sunbelts like Arizona, California, and Texas.

Today, the pair does not expect any significant and influential economic releases, whether from Japan or the United States.