The USD collapsing did not end, which surprised Forex traders, especially with the COVID-19 continuing to cause catastrophic human and economic losses, and the reason for record USD gains in the past few months. The collapse of USD/JPY pushed it to the 105.11 support, the lowest level in four and a half months, before settling around 105.40 in the beginning of Tuesday’s trading. The USD performance will be on for important releases starting today, Tuesday, with the results of a two-day meeting of the Federal Reserve Board on interest rates, and the final decision will be announced on Wednesday.

With its historic measures, the US central bank helped ending heavy selling in the market in March, which pushed it up dramatically, after promising to keep interest rates at record low levels and moving a wide range of bond purchases to support the economy. Investors are waiting to hear what the Federal Reserve is saying this week about the outlook for the economy and what it plans to do on interest rates.

This week, the USD will also react to corporate earnings results, with more than a third of the companies in the Standard & Poor's 500 Index reporting their success from April to June. So far, earnings reports have been better than Wall Street forecasts, although they are still much weaker than a year ago due to the recession. Analysts wrote in the BofA Global Research report that companies that posted results which exceeded expectations, were getting a bump smaller than usual against the rest of the market the next day.

Several of the market's most influential companies are due to report earnings reports this week, including Amazon, Apple, Facebook and Google's parent company. And these four make up 16% of the total value of S&P500, giving their moves a major impact on the index.

Concerns about an increase in layoffs across the US states sparked a drop in US stocks last week, as companies closed again amid a rise of COVID-19 cases. On the other hand, an additional $600 of weekly unemployment benefits from the United States government is due to expire soon, and Congress is still debating how to provide more assistance to the economy. In this regard, the chief negotiator for the Trump administration spent the weekend on Capitol Hill to work on a new stimulus bill, although Democrats and Republicans still have a lot to negotiate.

On the economic level: Expensive manufactured goods orders in the U.S. rose 7.3% in June, the second major monthly gain as manufacturing tries to break out of the spring recession caused by the COVID-19 pandemic. The US Department of Commerce announced that June's gains in durable goods orders, which were better than expected, followed a 15.1% increase in May. These increases came after sharp declines in March and April, as factories closed within the terms of the closure to contain the spread of the epidemic.

The closely watched trade investment gauge registered a strong 3.3% increase in June after a 1.6% rise in May. Even as factories return to life, economists warn that industrialization may decline again if escalating epidemic cases in many parts of the country disrupt a broader economic recovery.

The increase in June led a 20% increase in the transportation sector as orders for cars, trucks and parts increased 85.7%. This figure embodies the resumption of production by major automakers. Vehicle sales have offset a significant drop in orders for commercial aircraft as major airlines, with very low capacity, canceled orders for new aircraft from Boeing.

Excluding the volatile transportation sector, durable goods orders and items expected to continue for at least three years increased by 3.3%, after rising by 3.6% in May.

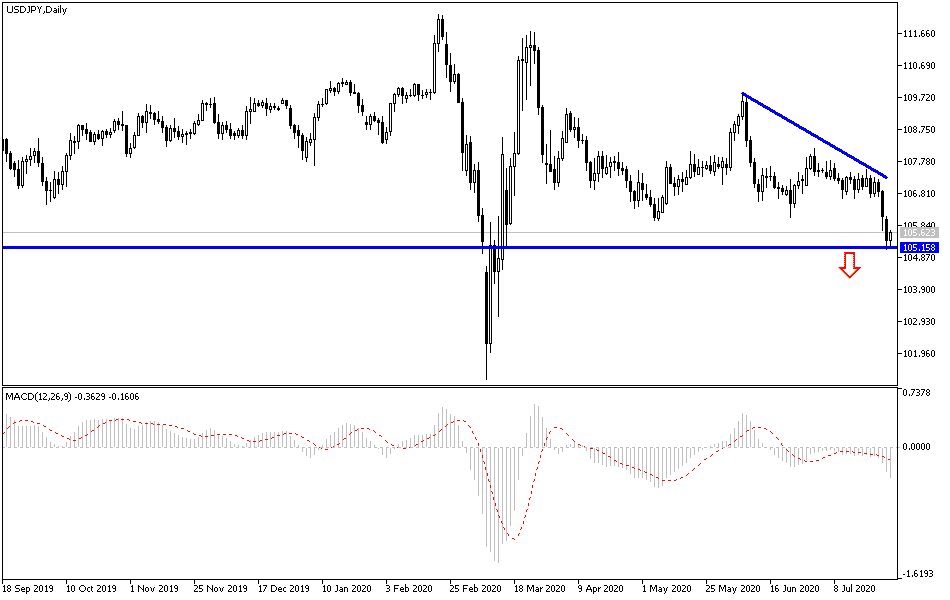

According to the technical analysis of the pair: Bears control over the general trend of USD/JPY is still the strongest and reaching the 105.00 support culminates the strength of technical indicators moving to oversold areas. The pair is best bought from support levels at 104.80, 104.00 and 103.65, respectively. There will be no real chance for a bullish correction without breaching the 108.00 resistance as a first stage. The strength of the second Coronavirus wave in the United States in particular, along with the tensions between the United States of America and China, will remain the most prominent engines of the pair. Today, the pair will react to the announcement of the American consumer confidence.