Bears still have stronger control over the USD/JPY performance, as the pair returned to the 106.66 support during yesterday's trading before settling around the 106.93 level in the beginning of Thursday's trading. The pair ignored the recent market optimism from the near arrival for a vaccine that would eliminate the COVID-19, as the United States is still leading the world in terms of infections and deaths. Recently, the biotechnology company (Moderna .MRNA) said its experimental vaccine for Covid-19 was safe and produced strong immune responses in all 45 patients in a continuous human trial at an early stage.

A tentative analysis of the first-stage open-label study of the vaccine candidate was published in the New England Journal of Medicine. In the wake of this recent positive news about vaccines from a few drug makers and other research companies, the announcement from Moderna raised optimism that the threat posed by the pandemic could be addressed in the relatively near future.

On the economic front, a report from the Federal Reserve showed that US industrial production rose 5.4% in June after jumping 1.4% in May. Economists had expected production to rise by 4.3%. Despite the significant increase, the Federal Reserve noted that industrial production remained 10.9% below its pre-pandemic level in February.

After four consecutive months of deflation, the New York Federal Reserve released a report on Wednesday showing growth in manufacturing activity in New York in July. The New York Federal Reserve said that overall business conditions rose to 17.2 in July from 0.2 in June, with a positive reading indicating growth in regional industrial activity. Economists had expected the index to jump to 10.0.

A report issued by the Ministry of Labor stated that import prices increased 1.4% in June, after increasing by 0.8% in May. Economists had expected import prices to jump by 1% in line with the increase originally reported for the previous month. The ministry also added that export prices also increased by 1.4 percent in June, after rising by a revised 0.4 percent in May. Export prices were expected to rise by 0.8 percent, compared to the 0.5 percent increase originally reported for the previous month.

However, the DXY dollar index fell to 95.78 in the middle of yesterday's trading but recovered to around 96.10 later. It was last seen at 96.04, down 0.23% from the previous close.

On the other hand, The Bank of Japan has maintained massive monetary policy stimulus as the Japanese economy is expected to contract more sharply in the current fiscal year due to the challenges posed by the COVID-19 virus. Accordingly, the Bank of Japan Policy Board voted by 8-1 to maintain the interest rate at -0.1% on current accounts held by financial institutions at the central bank. The bank will continue to purchase the necessary amount of Japanese government bonds without setting a ceiling so that the yields of the ten-year Japanese bond will remain at almost zero. The bank will actively buy mutual funds and Japanese real estate investment funds, so that the amounts due exceed an annual pace of a maximum of about 12 trillion yen and 180 billion yen, respectively.

As for corporate and corporate bonds, the bank will hold its outstanding amounts at 2 trillion yen and 3 trillion yen, respectively. Commenting on this, Marcel Thieliant, an economist at Capital Economics, said the bank is unlikely to announce major new measures in the coming months.

The Bank of Japan added in its statement that the economy is expected to improve gradually from the second half of the year with the resumption of economic activity, but the pace is expected to be only moderate while the effect of the new coronavirus remains around the world.

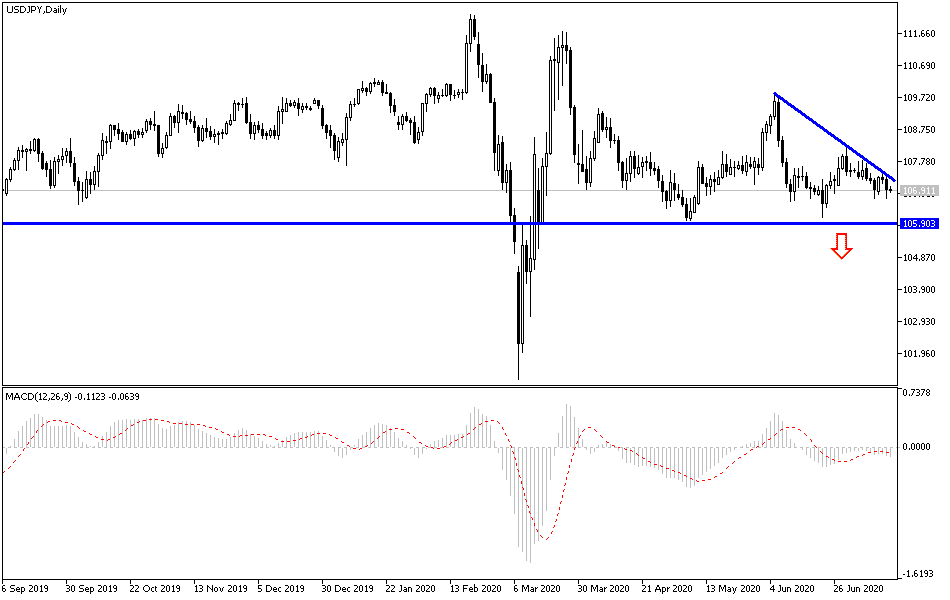

According to the technical analysis of the pair: The general trend of the USD/JPY pairs remains bearish and stable below 108.00 supports continuous bear control on the performance, but it must be taken into account that the technical indicators have reached strong oversold areas, and therefore, investors may consider profits from a rebound with purchases. I see the appropriate levels for that are 106.60, 105.90, and 104.85 respectively. Upside bounce targets might first reach the important 108.00 level and a stronger confirmation of a downside reversal will be the next move towards 109.60 resistance.

The Japanese yen will react today to the release of Chinese economic data early in the morning, and later, US releases include retail sales figures, jobless claims and the Philadelphia Industrial Index.