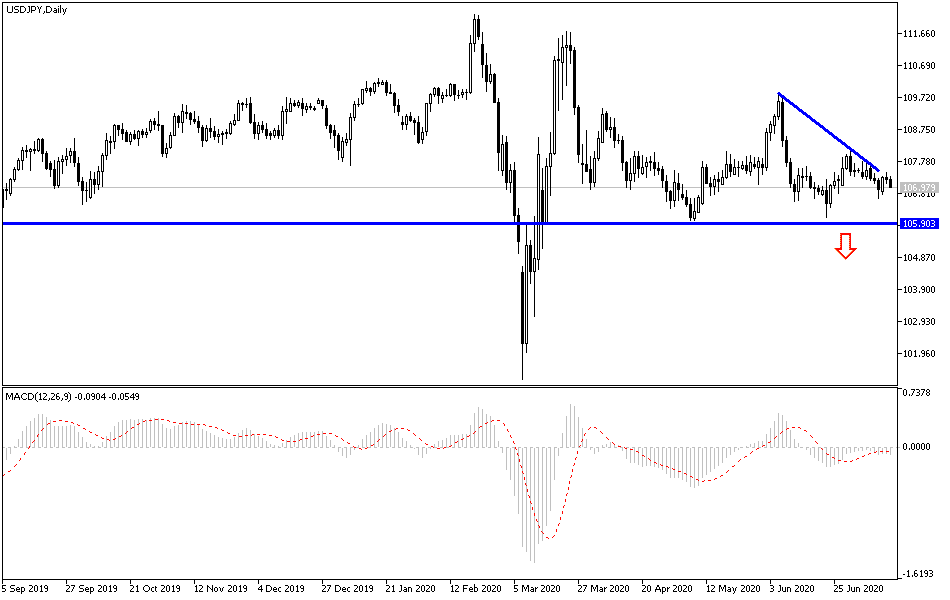

The continued monitoring of increasing numbers of new infections with the Coronavirus in the United States, along with the renewed tensions between the two largest economies in the world, are the most important factors that explain the continued downward pressure on the USD/JPY, which is struggling to return to stability above the 108.00 resistance to exit the bearish channel that is in control since the beginning of the current month’s trading. Its recent losses has pushed the pair to the 106.63 support before settling around the 107.30 level at the time of writing. There is a noticeable caution among investors until the announcement of the profit season for American companies in the pandemic era, which contributed to paralyzing the global economy for months. Risk appetite declined after the United States rejected a number of disputed Beijing maritime claims in the South China Sea, and indicated that the White House could soon turn its attention to Chinese companies listed on US stock markets in a way that further added to the tensed mood among investors.

The Chinese government has warned that it will protect Chinese companies after Washington said that companies may face legal problems if they help in committing abuses in the northwestern Xinjiang region. The US warning came amid heightened tension with Beijing over human rights and trade and Hong Kong. It cited complaints of violations by the ruling Communist Party against ethnic Muslims, including mass detention and forced labor. The Commerce Department accused the US government of interfering in China's affairs, stating that Washington was misusing human rights complaints to "suppress Chinese companies."

"This is bad for China, bad for the United States, and bad for the whole world," said a ministry statement. The ministry also added that "China strongly urges the United States to stop its bad actions." And "China will take the necessary measures to firmly protect the legitimate rights and interests of Chinese companies."

The US warning issued on July 1 said that companies dealing with goods that are produced through forced labor or supply technology that can be used in labor camps or for surveillance may face unspecified "reputation, economic, and legal" risks. China has detained an estimated one million or more members of Muslim minorities in concentration camps. The government describes them as vocational training facilities designed to counter Islamic extremism and separatist trends. It says those facilities have since been closed, a claim that is impossible to be confirmed given the restrictions on visits and reporting on the area.

Veterans in those camps and their family members say that detainees are often forced, with the threat of violence, to condemn their religion, culture, language, and loyalty to the leader of the Communist Party and head of state Xi Jinping. Therefore, the US government imposed sanctions on four Chinese officials, including prohibiting real estate dealings with them by the Americans. Beijing responded by declaring unspecified sanctions to four US senators who criticize the ruling party's policies toward ethnic and religious minorities.

On the other hand, adding to the volatility of the stock and currency markets, the State of California, the largest US state in terms of population, announced the re-imposition of a number of "closure" restrictions in an attempt to contain the rise in new COVID-19 cases.

According to the technical analysis of the pair: On the daily USD/JPY chart, the pair is still in a downward correction, and is stable below 108.00, confirming the strength of the bear's control over the performance. There is still room to test stronger support levels, the closest are currently at 106.85 and 106.00 respectively, and the last level will push technical indicators to strong oversold areas. On the other hand, there will be no real success for a trend reversal and stronger bulls’ control without returning to the psychological resistance area at 110.00.

As for the economic calendar data: After the Japanese Central Bank announces its monetary policy, the US industrial production rate will be announced.