There is no escape of bears dominating the USD/JPY performance. In an unusual manner, investors have abandoned the US currency for a long time despite the strength of the second wave of COVID-19, which remains a threat to the global economy. Throughout this week's trading, the pair was stable between the 106.68 level and the 107.53 level, and is settling around the 107.20 level at the beginning of Thursday's trading, which paves the way for a new weekly bearish close. The DXY dollar index reached its lowest level in four months after witnessing a limited recovery amid fears about a coronavirus outbreak in the United States and an increase in geopolitical tensions. These factors were not enough though to support the dollar further. Commenting on the alarming numbers of US coronavirus infections, US President Donald Trump said in a news conference, "The Chinese virus is an evil and dangerous disease, but we have learned a lot about it and who is it targeting. Some regions of our country are doing well, while others are not doing so well. Unfortunately, it is likely for things to get worse before it gets better - something I don't like to say, but it is a fact. The pandemic is all over the world.”

Americans increased their home purchases in June by 20.7%, a strong percentage after the pandemic caused sales to collapse in the previous three months. At the same time, the housing market is struggling to rebound further in the face of the virus outbreak and a shrinking supply of homes for sale. The National Association of Realtors said on Wednesday that existing US home sales rose last month to an annual seasonally adjusted average of 4.72 million. Despite the sharp gains, purchases remain 11.3% lower than last year, when homes were sold at an annual pace of 5.32 million. Lawrence Yun, chief economist of the brokers, noted that sales are still almost 20% lower than pre-pandemic levels.

Meanwhile, housing has managed to avoid a deeper recession than the severe stagnation caused by the coronavirus, as demand remained strong among buyers who managed to weather the economic downturn, while record-low mortgage rates helped maintain affordability.

The number of real estate listings decreased by 18.2% from last year to 1.57 million. It is the thirteenth month in a row that the supply decreases on an annual basis. The shortage of homes will make it unlikely that the housing industry will boost the economy in general. Homebuyers usually buy new furniture and repair old properties. Their ability to make this payment is restricted if they cannot find an available home. The limited supply imposes higher prices at a time when many Americans suffer from financial uncertainty due to the recession.

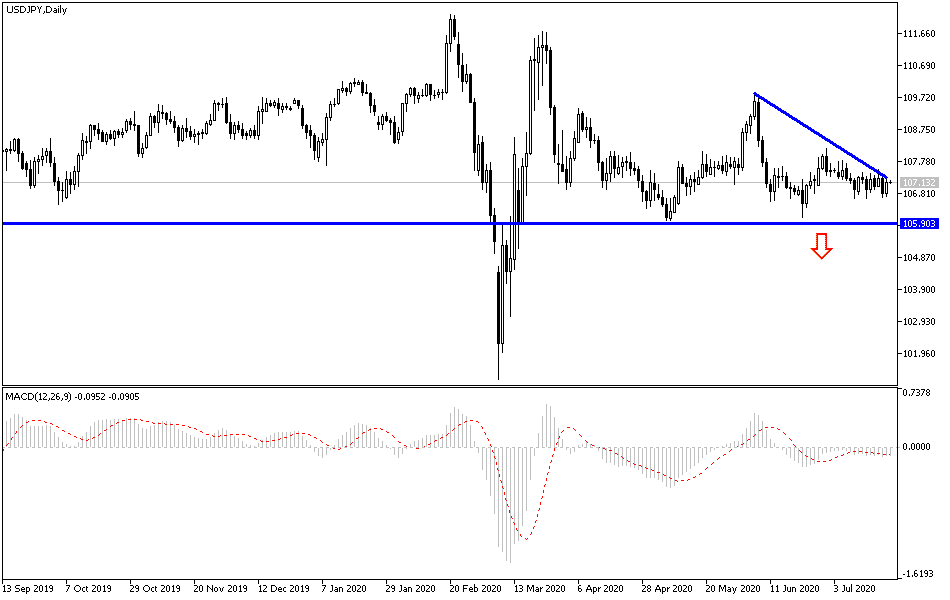

According to the technical analysis of the pair: The general USD/JPY trend is still bearish, and stability below 108.00 supports the continuation of that. The bears still have control and can push the pair back towards the support levels 106.66, 105.80, and 1.05.00, respectively. These are strong oversold areas, according to the performance of technical indicators. We may see a reversal of the current trend if the pair moves towards the resistance levels 107.85, 108.55, and 109.35, respectively. I still prefer buying the pair from every lower level. Amid a Japanese holiday, the focus will be on US economic issues; jobless claims, and the reading of leading US indicator.